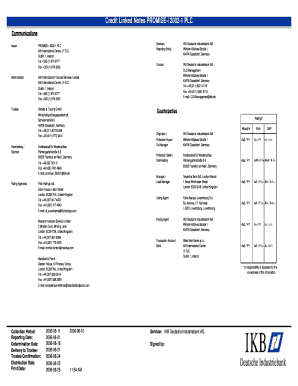

Get Credit Linked Notes Promise-i 2002-1 Plc Counterparties Communications Issuer Promise-i 2002-1 Plc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Credit Linked Notes PROMISE-I 2002-1 PLC Counterparties Communications Issuer online

Filling out the Credit Linked Notes PROMISE-I 2002-1 PLC form is essential for ensuring accurate communication between counterparties and the issuer. This guide will provide you with step-by-step instructions to navigate the online form efficiently.

Follow the steps to complete the form accurately.

- Press the ‘Get Form’ button to access the form and open it in the editor.

- Review the issuer's details clearly listed at the top, which include contact information for the AIB International Centre and the administrator AIB International Financial Services Limited. Ensure accuracy in this section as it directly relates to communication with counterparties.

- Fill in the currency section, which should state 'Euro' as that is the denomination used for the Credit Linked Notes.

- Complete the collection period dates, reporting dates, and any determination dates. Consistency in these dates is crucial for tracking financial operations.

- Provide detailed information for each component of the Remittance Distribution Data. This includes various balances such as the initial principal balance, actual maximum balance of credit default swaps, and total principal repayment.

- Enter data pertaining to current period claims and losses, including the number of claims paid in full and cumulative realized losses, ensuring that data is accurate and reflective of the report period.

- Review the covenant tests carefully, ensuring that the criteria meet the specified limits. This may involve checking that minimum and maximum limits are passed as indicated.

- Once you have accurately filled out all required fields and reviewed for precision, you may choose to save changes, download, print, or share the completed form.

Ensure all documents are completed thoroughly and submit them online for streamlined processing.

The primary difference between a credit linked note and a credit default swap lies in their structure and function. Credit linked notes offer a return based on the performance of underlying credits, while credit default swaps serve as insurance against default. Investors can assess their risk appetite when choosing between these instruments, especially within the context of Credit Linked Notes PROMISE-I 2002-1 PLC Counterparties Communications Issuer PROMISE-I 2002-1 PLC.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.