Loading

Get Sole Traders And Partnerships

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sole Traders and Partnerships online

Filling out the Sole Traders and Partnerships form online can be a straightforward process if you follow the right steps. This guide aims to provide clear instructions and helpful tips tailored for users of all experience levels.

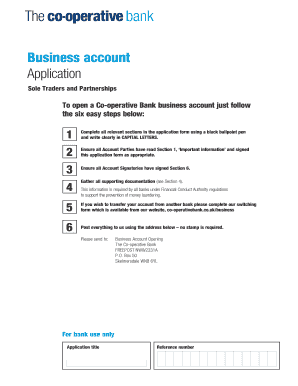

Follow the steps to successfully complete the application.

- Click ‘Get Form’ button to obtain the application and ensure it is opened in your preferred digital editor.

- Complete all relevant sections in the application form using a black ballpoint pen and write clearly in capital letters.

- Ensure all account parties have read the Important Information section and signed the application form where necessary.

- Confirm that all account signatories have signed at the designated section of the form to authorize banking actions.

- Gather and prepare all supporting documentation as specified in Section 4 of the form, which may include bank statements or partnership agreements.

- If you are transferring your account from another bank, complete the appropriate switching form required for the transfer.

- Submit the completed form and all required documents by mailing everything to the provided address, noting that no postage is needed.

- After submission, make sure to save any changes, and consider downloading or printing the application for your records.

Begin your application process online today and take the first step towards managing your business account effectively.

Yes, a sole trader can enter into a partnership. This can happen if an individual operating as a sole trader decides to collaborate with one or more partners. This flexibility allows for evolving business models, showcasing the versatility within the realm of sole traders and partnerships.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.