Loading

Get Mn F321r10 2009-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MN F321R10 online

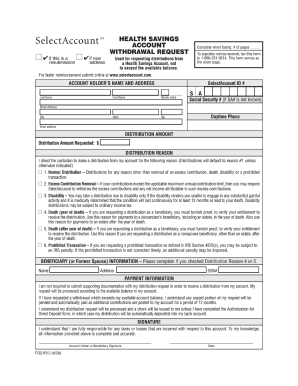

This guide provides comprehensive instructions for filling out the MN F321R10 form, designed for those requesting distributions from a Health Savings Account. Whether you are familiar with such forms or approaching it for the first time, this guide aims to support you through the process.

Follow the steps to successfully complete your MN F321R10 form online.

- Click the ‘Get Form’ button to access the document and open it in your preferred online editor.

- Begin by filling out the account holder's name and address section. Provide your last name, first name, and middle initial, along with your street address, city, state, zip code, and daytime phone number.

- Enter your SelectAccount ID number. If you do not know it, provide your Social Security number instead.

- Indicate the distribution amount requested by entering the desired dollar amount in the specified field.

- Select the distribution reason from the provided options. Choose from normal distribution, excess contribution removal, disability, death (year of death), death (after year of death), or prohibited transaction, ensuring to provide any necessary supporting information as needed.

- If you selected a distribution reason related to death, complete the beneficiary (or former spouse) information section by providing the name, address, and Social Security number of the beneficiary.

- Review the payment information section to confirm that you are aware of the requirements regarding supporting documentation and the processing of your request.

- Sign and date the form in the signature section to confirm the accuracy of the information provided and your understanding of any tax implications associated with the account.

- After completing the form, you can save changes, download it to your device, print a physical copy, or share it as needed.

We encourage you to complete your MN F321R10 form online for a quicker and more efficient processing experience.

Seniors in Minnesota can qualify for property tax deferrals or exemptions depending on their age and income. Generally, those 65 and older may be eligible for benefits that can reduce or defer property taxes. MN F321R10 provides comprehensive resources on how seniors can navigate these options effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.