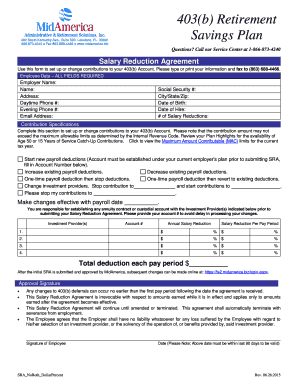

Get Midamerica 403(b) Retirement Savings Plan 2015-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign MidAmerica 403(b) Retirement Savings Plan online

How to fill out and sign MidAmerica 403(b) Retirement Savings Plan online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

The creation of legal documents can be expensive and time-consuming.

Nevertheless, with our pre-set online templates, the process becomes easier.

Utilize the rapid search and advanced cloud editor to create an accurate MidAmerica 403(b) Retirement Savings Plan. Streamline the process and create documents online!

- Locate the template in the library.

- Fill in all required details in the designated fillable fields.

- The intuitive drag-and-drop interface allows for easy addition or relocation of fields.

- Verify that all entries are correct, with no spelling errors or missing information.

- Add your electronic signature to the document.

- Simply click Done to finalize the updates.

- Save the file or print your version.

- Send it immediately to the recipient.

How to modify Get MidAmerica 403(b) Retirement Savings Plan 2015: personalize documents online

Enjoy a hassle-free and digital approach to changing Get MidAmerica 403(b) Retirement Savings Plan 2015. Utilize our reliable online tool and save a significant amount of time.

Creating each document, including Get MidAmerica 403(b) Retirement Savings Plan 2015, from the beginning takes excessive effort, so having a proven platform of pre-uploaded document models can greatly enhance your efficiency.

However, altering them can be difficult, particularly with files in PDF format. Fortunately, our vast library includes an integrated editor that enables you to effortlessly fill out and personalize Get MidAmerica 403(b) Retirement Savings Plan 2015 without leaving our site, ensuring you don’t waste your valuable time modifying your documents. Here’s how to handle your form using our service:

Whether you need to finalize editable Get MidAmerica 403(b) Retirement Savings Plan 2015 or any other form available in our catalog, you’re headed in the right direction with our online document editor. It’s straightforward and secure and does not require any specialized skills. Our web-based solution is crafted to manage practically everything you might require concerning document modification and execution.

Move away from the antiquated methods of handling your documents. Opt for a more efficient alternative to assist you in streamlining your tasks and minimizing reliance on paper.

- Step 1. Locate the required document on our site.

- Step 2. Click Get Form to access it in the editor.

- Step 3. Utilize advanced editing tools that allow you to add, delete, annotate, and emphasize or conceal text.

- Step 4. Create and append a legally-valid signature to your document using the signing option from the upper toolbar.

- Step 5. If the document format doesn’t appear the way you desire, use the options on the right to eliminate, add, and rearrange pages.

- Step 6. Insert fillable fields so others can be invited to complete the document (if needed).

- Step 7. Distribute or send the document, print it, or choose the format in which you wish to download it.

Yes, if you take a distribution from your MidAmerica 403(b) Retirement Savings Plan, you will receive a 1099-R form. This form outlines the total amount distributed during the year and indicates how much of that amount is taxable. You will need this information when preparing your tax return.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.