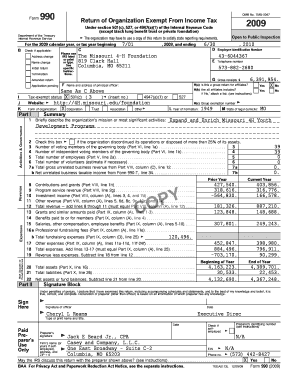

Get 1545-0047 Return Of Organization Exempt From Income Tax 2009 Under Section 501(c), 527, Or

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1545-0047 Return Of Organization Exempt From Income Tax 2009 Under Section 501(c), 527, Or online

Filling out the 1545-0047 Return Of Organization Exempt From Income Tax can be a straightforward process with the right guidance. This guide provides step-by-step instructions to help you complete the form accurately and efficiently using online resources.

Follow the steps to successfully complete the form.

- Click the 'Get Form' button to access the form online and open it in your preferred editing tool.

- Begin with Part A, where you need to provide your organization's name, employer identification number (EIN), and address. Be sure to indicate any changes in the organization’s address or name.

- In Part B, check the appropriate boxes for the status of your return (such as initial return, amended return, or termination). This helps the IRS classify your submission correctly.

- In Section C, enter the gross receipts and any other financial details required. Accurately reporting your income is important for compliance.

- Provide details on the type of tax-exempt status your organization is claiming in Section D. Make sure to enter any specific codes associated with such status.

- For Parts VIII and IX, detail your organization's revenue and expenses. It is essential to break this down accurately as it reflects your financial health.

- Complete the signature block at the end of the form. This includes signatures from appropriate officers, as well as the date of submission.

- Once you have filled in all sections, review the form for accuracy. Make necessary adjustments before proceeding.

- Finally, you can save changes, download, print, or share the form as needed, ensuring you keep a copy for your records.

Start completing your 1545-0047 Return Of Organization Exempt From Income Tax form online today!

An organization exempt from tax under Section 501(a) operates for purposes defined by the Internal Revenue Code and meets specific regulatory criteria. These organizations can engage in a variety of activities, yet must adhere to guidelines that prevent private benefit and commercial purposes. To keep their exempt status intact, they must regularly file necessary paperwork, such as the 1545-0047 Return Of Organization Exempt From Income Tax 2009 Under Section 501(c), 527, Or.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.