Loading

Get Maof St1-05 2011-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MAOF ST1-05 online

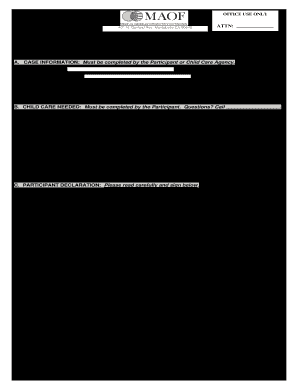

The MAOF ST1-05 is an important application for child care services under the CalWORKs Stage 1 program. This guide will provide you with clear, step-by-step instructions to help you successfully complete the form online.

Follow the steps to fill out the MAOF ST1-05 form accurately.

- Press the ‘Get Form’ button to retrieve the MAOF ST1-05 application form and open it for editing.

- In Section A (Case Information), complete all required fields, including participant name, CalWORKs case number, address, and contact information. Make sure to accurately enter your information to avoid delays.

- In Section B (Child Care Needed), provide the names and birth dates of all children who will require child care. Ensure that you fill out a separate form for each provider.

- Specify the date when you need child care to begin and indicate if you are requesting all eligible child care hours based on your approved activities.

- Read through Section C (Participant Declaration) carefully. Sign and date the form to confirm that you acknowledge and agree to the terms outlined regarding child care services.

- In Section D (Provider Information), ensure that the selected child care provider completes their section, including provider name, address, and type of care. This part must be filled out accurately for payment to be processed.

- For license-exempt individuals, provide the required rates for services rendered. Ensure they match what will be charged to the parent and complete the Provider Declaration.

- Review all entries for accuracy and completeness before submitting the application.

- Once you have reviewed and confirmed that all information is correct, save your changes. You may then download, print, or share the completed MAOF ST1-05 application as needed.

Complete your MAOF ST1-05 application online today to ensure timely processing of your child care services!

The responsible party when applying for an EIN for a trust is the person who controls the trust. This individual will need to be identified in the application and must provide their Social Security Number or individual taxpayer identification number. Ensuring clarity in this role is essential for smooth processing. USLegalForms can be an invaluable resource as you navigate MAOF ST1-05 for trust-related matters.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.