Get Earnings Are Allowed Beginning 12/26/2012 Through 05/17/2013, With The Exception Of Official

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Earnings Are Allowed Beginning 12/26/2012 Through 05/17/2013, With The Exception Of Official online

This guide provides clear, step-by-step instructions on how to accurately fill out the Earnings Are Allowed form for the specified period. It is designed for users of all experience levels to navigate the digital documentation process with ease.

Follow the steps to complete the form online effectively.

- Click the ‘Get Form’ button to access the form and open it in the online editor.

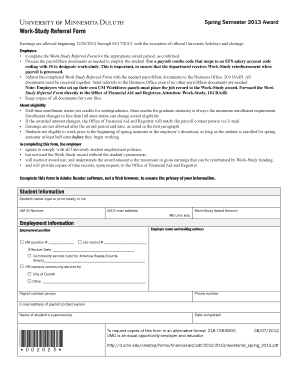

- Begin by entering the student information, including the full name, UM ID number, and UM email address. Ensure the details are precise, as any errors may delay processing.

- Fill out the employment information section. Include the work-study award amount, employer's name, and mailing address.

- Specify the employment position by checking the appropriate boxes and including any necessary job record numbers or effective dates.

- Identify whether the position involves community service and fill in site details if applicable.

- Complete the payroll contact information, ensuring that the phone number and email address of the payroll contact person is included.

- List the name(s) of the student's supervisor(s) to ensure clear communication.

- Review all inputs for accuracy, ensuring compliance with university employment policies.

- Save your changes, then download, print, or share the form as needed to submit to the Business Office.

Start completing your documents online to ensure timely processing.

A letter of ruling from the IRS is a written response to a specific inquiry concerning the tax treatment of certain transactions. This letter helps clarify how tax laws apply in distinct circumstances, offering more personalized guidance. For those wondering how earnings are potentially affected, especially during the specified period of 12/26/2012 through 05/17/2013, these letters can provide peace of mind and assurance in tax matters.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.