Loading

Get Ebooks-gratuits.me Bad Debts Expense Is Considered.pdf : 11100 ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ebooks-Gratuits.Me Bad Debts Expense Is Considered.pdf : 11100 online

This guide provides a detailed overview for filling out the Ebooks-Gratuits.Me Bad Debts Expense Is Considered.pdf : 11100. The instructions are tailored to assist users, regardless of their prior experience with legal forms.

Follow the steps to complete your form online effectively.

- Click the ‘Get Form’ button to access the document. This will open the form in your web browser, allowing you to start filling it out.

- Identify the sections that require your input. Review each field carefully, ensuring that you understand what information is being requested. Provide accurate and complete information.

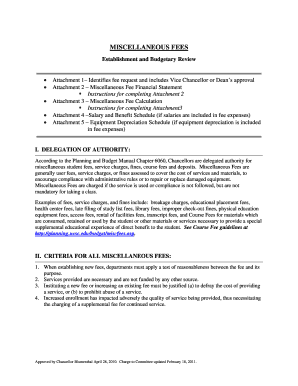

- In Attachment 1, outline the details of your miscellaneous fee request, including the department, contact information, and the reasons for the fee.

- Complete Attachment 2 by providing a financial statement that outlines the expected revenues and expenses associated with the proposed fees.

- Fill out Attachment 3 by detailing the fee calculation, ensuring to include projected numbers for the current and proposed fiscal years.

- If applicable, complete Attachment 4 to provide details about salaries and benefits related to the fee expenses.

- Complete Attachment 5 to detail any depreciation expense for equipment related to the fees.

- Ensure that all the necessary attachments are included with your proposal and submit them as instructed, ensuring compliance with any deadlines.

- Review all filled sections to make sure there are no errors or omissions before finalizing.

- Once you have reviewed the document, save your changes, then choose to download, print, or share the completed form as required.

Get started with your document submissions online today!

The IRS Form 1040 is the standard federal income tax form that individuals use to report their income, deductions, and tax liabilities to the federal government. This form is the foundation for calculating your tax obligations and allows for various credits and deductions that can lower your total tax bill. For detailed understandings of its sections, Ebooks-Gratuits.Me Bad Debts Expense Is Considered.pdf : 11100 can serve as a useful resource.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.