Get Payment Instructions & Schedule

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Payment Instructions & Schedule online

Filling out the Payment Instructions & Schedule is an important step for managing your financial commitments during your academic year. This guide will provide clear, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to successfully complete the form

- Click ‘Get Form’ button to obtain the form and open it in the editor.

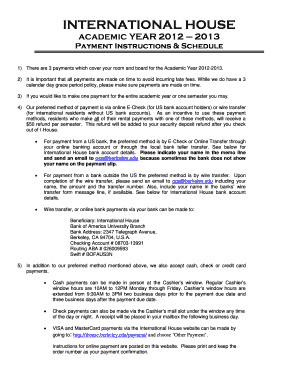

- Review the payment schedule, noting the due dates for each installment. Ensure you understand the importance of making payments on time to avoid late fees.

- Choose your preferred method of payment: online E-Check for US bank account holders or wire transfer for international residents. Make note of the bank account details required for the transaction.

- If paying via E-Check, access your online banking and initiate the transfer, ensuring to include your name in the memo line. Send a confirmation email to qcs@berkeley.edu.

- For wire transfers, follow the bank’s instructions and be sure to include your name and payment details in the message line, where applicable. After completing the transfer, email qcs@berkeley.edu with your transaction information.

- Alternative payment methods include cash, check, or credit card. If using cash or check, ensure you are aware of the Cashier’s window hours for in-person payments.

- For credit card payments, visit the designated payment link and follow the instructions provided, making sure to save your confirmation number.

- Confirm all payment details and check that all sections of the form are filled out correctly before submitting.

- Once completed, save your changes, and choose to download, print, or share your form as needed.

Start filling out your Payment Instructions & Schedule online today for a smooth financial experience!

Line 16 on your tax schedule can refer to specific income entries that must be tallied for accurate tax reporting. Depending on the type of schedule you are using, it could encompass various items that contribute to your overall income. It's essential to understand this line to ensure you meet your tax filing requirements. If you need assistance, resources from USLegalForms can simplify your understanding of payment instructions & schedule.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.