Loading

Get Individual Account Cancellation Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Individual Account Cancellation Form online

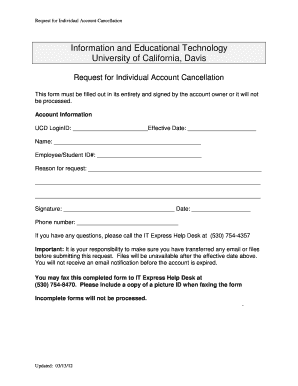

Filling out the Individual Account Cancellation Form is an important step for users wanting to terminate their account. This guide will provide you with clear and detailed instructions to ensure the process goes smoothly.

Follow the steps to complete the form accurately

- Select the ‘Get Form’ button to access the Individual Account Cancellation Form and open it in an online editor.

- In the account information section, enter your UCD LoginID in the designated field. This is essential for identifying your account.

- Next, fill out the effective date field. This is the date on which you would like your account cancellation to take effect.

- Provide your full name in the specified area to ensure proper identification as the account owner.

- Enter your Employee or Student ID number in the corresponding field. This helps further confirm your identity.

- In the reason for request section, clearly state your reason for cancelling the account. Be as precise as possible while keeping it concise.

- Sign the form and enter the current date to validate your request.

- Lastly, provide a phone number where you can be reached for any follow-up questions. Ensure the number is correct.

- After completing the form, review all entries for accuracy to prevent processing delays. You can then save, download, print, or share the form as needed.

Take the next step toward managing your account by completing the Individual Account Cancellation Form online.

When you dissolve your LLC, your EIN does not automatically go away. You must notify the IRS of your dissolution by submitting the Individual Account Cancellation Form. This form ensures that your EIN is appropriately removed and that no further tax obligations exist.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.