Get 2013-2014 Verification Irs Tax Return Transcripts - Ursuline

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2013-2014 verification IRS tax return transcripts - Ursuline online

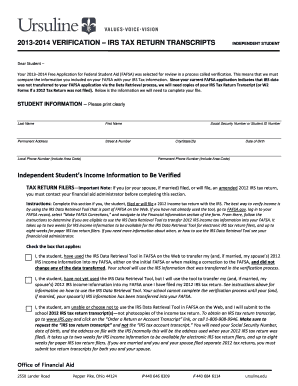

This guide provides a detailed overview of how to complete the 2013-2014 verification IRS tax return transcripts for Ursuline. By following these instructions, users can ensure they accurately provide the necessary information to complete their financial aid process.

Follow the steps to accurately complete your form.

- Click ‘Get Form’ button to access the official document you need for verification and open it in your preferred editor.

- Begin by filling out the student information section. Clearly provide your last name, first name, permanent address, local phone number, social security number or student ID number, date of birth, and permanent phone number.

- If you filed a 2012 income tax return, indicate whether you used the IRS Data Retrieval Tool when completing your FAFSA. Choose the applicable checkbox to confirm if you transferred your tax information or plan to do so.

- If you did not use the IRS Data Retrieval Tool, check the box that states you are unable to do so and that you will instead submit the necessary IRS tax return transcripts. Follow the provided instructions to obtain your transcripts from the IRS.

- For students who did not file a tax return, complete the non-filer section. Indicate your employment status in 2012 and list all employers alongside the amount earned. Ensure you include copies of your W-2 forms as attachments.

- Finally, certify the accuracy of all the information by signing the worksheet. Include your date of signature and, if applicable, your spouse's signature.

- Once you have completed and reviewed the form, save your changes, and download or print a copy for your records. Submit it as directed to the financial aid office.

Complete the necessary documents online to ensure a smooth verification process.

To verify your tax return with the IRS, you can use the IRS’s online tools to check your tax account or request your tax transcripts. If you are using a lender, they may require you to complete a 4506-C form, enabling them to get that verification directly. This is particularly pertinent when conducting 2013-2014 VERIFICATION IRS TAX RETURN TRANSCRIPTS - Ursuline, as it guarantees that your information is accurate and up-to-date.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.