Get 2013-14 Student Tax Filing Information Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2013-14 STUDENT TAX FILING INFORMATION FORM online

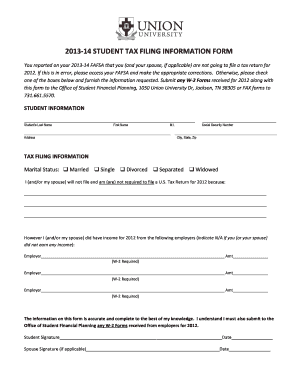

Filling out the 2013-14 student tax filing information form is a crucial step for students seeking financial aid. This guide will provide you with clear instructions on how to complete each section of the form online, ensuring a smooth submission process.

Follow the steps to successfully complete your form.

- Press the ‘Get Form’ button to access the 2013-14 student tax filing information form and open it in your document editor.

- Fill in your student information. This includes your last name, first name, middle initial, address, social security number, and city, state, and zip code.

- Indicate your marital status by selecting one of the options: married, single, divorced, separated, or widowed.

- State the reason for not filing a U.S. tax return for 2012 in the designated area. If applicable, provide a brief explanation.

- List any income earned in 2012 from your employers. For each employer, provide their name and the amount earned. If you or your spouse did not earn any income, indicate N/A.

- Review the information you have entered for accuracy and completeness. Ensure that you have provided all necessary details.

- Sign and date the form in the designated signature areas. If applicable, have your spouse sign and date as well.

- Submit any required W-2 forms along with this completed form. Ensure they are sent to the Office of Student Financial Planning via mail or fax.

- Save your completed form for your records. You may also download, print, or share the form as needed.

Complete your student tax filing information form online today for a seamless financial aid application process.

Yes, you can pull your own IRS transcripts online using the IRS's online services. You will need to create an account or log in with your existing credentials to view and download your transcripts directly. This access is especially useful when preparing to complete your 2013-14 student tax filing information form. Utilizing online resources makes managing your tax documents much easier.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.