Loading

Get Payroll Payment Cancellation Form - Payroll Services

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Payroll Payment Cancellation Form - Payroll Services online

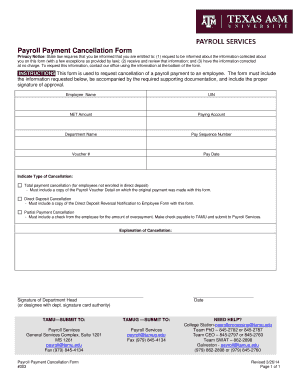

The Payroll Payment Cancellation Form is a crucial document for managing payroll issues. This guide provides step-by-step instructions on how to accurately complete and submit yours online.

Follow the steps to successfully fill out your form.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Enter the employee's name in the designated field. Ensure that you provide the correct and full name for accurate processing.

- Input the Unique Identification Number (UIN) of the employee in the corresponding field. This number is critical for identifying the employee correctly.

- Enter the net amount related to the payroll payment you wish to cancel. Double-check this figure for accuracy.

- Indicate the account from which the payment is being processed by filling in the paying account section.

- Note the department name responsible for this payroll payment in the provided field.

- Locate and enter the pay sequence number associated with the payment.

- Fill in the voucher number linked to the payroll payment.

- Specify the pay date for the original payroll payment in the appropriate space.

- Select the type of cancellation you are requesting. You can choose from total payment cancellation, direct deposit cancellation, or partial payment cancellation, and make sure to provide the required supporting documentation as specified.

- Provide a clear explanation of the cancellation in the designated area. Be concise and include relevant details.

- Have the form signed by the department head or an authorized designee. Ensure the signature aligns with the department's signature card authority.

- Enter the date on which the form is being signed.

- After completing the form, review all entries for accuracy, then save your changes. You may download, print, or share the form as needed.

Ensure timely processing of payroll cancellations by completing and submitting your forms online today.

Yes, a payroll check can be cancelled under specific circumstances, often depending on the timing of your request. It's essential to void the check promptly to avoid complications. If you need detailed guidance or templates to facilitate this process, refer to the Payroll Payment Cancellation Form - Payroll Services for further assistance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.