Loading

Get Tc Form 6a 2018-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TC Form 6A online

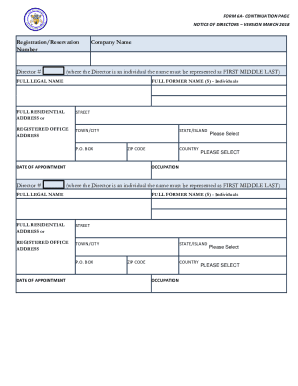

Filling out the TC Form 6A online can seem daunting, but with the right guidance, it can be a straightforward process. This guide provides step-by-step instructions to help users complete the form accurately and efficiently.

Follow the steps to successfully complete the TC Form 6A.

- Click the ‘Get Form’ button to obtain the TC Form 6A and open it in the designated editor.

- Begin by entering the registration or reservation number associated with your company. This information is essential for identifying the correct entity.

- In the Director # field, provide the number corresponding to the director being appointed or updated.

- Enter the full legal name of the director using the format FIRST MIDDLE LAST. Ensure that the name matches the official documents.

- If the director has any former names, include those in the FULL FORMER NAME(S) field.

- Provide the full residential address of the director. This should include the street address, town or city, state or island, and ZIP code.

- Complete the REGISTERED OFFICE ADDRESS section with the official address of the company's registered office.

- Select the appropriate date of appointment for the director from the date picker or enter it manually.

- Indicate the occupation of the director from the available options in the OCCUPATION field.

- Review all entries to ensure accuracy. Make necessary adjustments if any information is incorrect.

- Once you have filled out all required fields, save your changes, and you can choose to download, print, or share the form as needed.

Complete your TC Form 6A online today for a smooth filing experience.

Whether you should claim 0 or 1 on your W4 largely depends on your tax situation. If you claim 0, more taxes are withheld, which may lead to a refund when you file, while claiming 1 will reduce the withholding amount. Evaluating your financial situation with the help of the TC Form 6A can provide a more tailored recommendation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.