Loading

Get Revised 492 8-31-11

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Revised 492 8-31-11 online

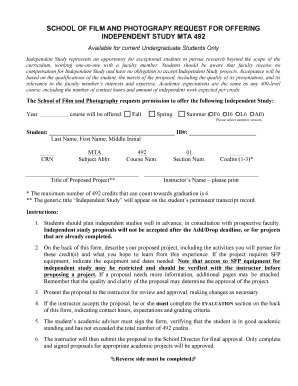

The Revised 492 form is a critical document for students interested in pursuing an Independent Study within the School of Film and Photography. This guide will provide you with a step-by-step approach to filling out the form accurately and effectively.

Follow the steps to complete the Revised 492 form online.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Provide your personal information in the designated fields. Enter your last name, first name, and middle initial, followed by your ID number.

- Select the semester during which the course will be offered by checking the appropriate box for Fall, Spring, or Summer.

- Fill out the course number, section number, and credits you are requesting (between 1-3 credits). Please note that a maximum of 6 credits can be counted towards graduation.

- Print the instructor’s name clearly in the designated area.

- On the reverse side of the form, type a detailed project description, including the activities you plan to pursue and the equipment you will need, along with dates.

- Outline your learning objectives, specifying what you hope to gain from this Independent Study.

- List a bibliography of relevant sources that support your proposed project.

- Once the proposal is drafted, present it to your instructor for review and approval. Make any necessary adjustments based on their feedback.

- Ensure that your instructor completes the evaluation section on the back, detailing expectations, contact hours, and grading criteria.

- Obtain signatures from yourself, the instructor, your academic advisor, and the School Director to finalize the proposal.

- After completing and signing the form, you can save changes, download, print, or share your completed document.

Begin filling out the Revised 492 form online today to embark on your Independent Study journey.

Related links form

There is typically no penalty for simply revising your income tax return; however, owing additional taxes can result in interest fees. It is important to address any changes related to the Revised 492 8-31-11 as soon as possible to minimize potential penalties. Keeping your tax filings accurate is imperative for smooth financial management. Consultation with a tax advisor can also provide clarity.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.