Loading

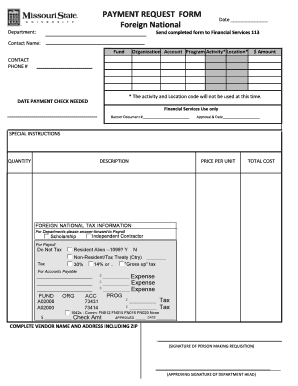

Get Payment Request Form Foreign National

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PAYMENT REQUEST FORM Foreign National online

This guide provides clear instructions on how to accurately complete the PAYMENT REQUEST FORM for Foreign Nationals online. Follow these detailed steps to ensure the form is filled out properly, facilitating the payment process.

Follow the steps to successfully fill out the PAYMENT REQUEST FORM Foreign National.

- Press the ‘Get Form’ button to access the PAYMENT REQUEST FORM Foreign National and open it in your preferred editor.

- In the 'Department' section, enter the relevant department that is requesting payment. This will help clarify which budget is being utilized for the payment.

- Fill in the 'Date' field with the current date to indicate when the form is being completed.

- Provide the 'Contact Name' who is associated with this payment request. This should be someone who can answer questions regarding the submission.

- Enter the specific 'Fund' and 'Organization Account' details. These fields will direct the payment to the correct financial account.

- Include the 'Program Activity' and 'Location' for internal tracking, noting that the activity and location codes may not be utilized at this time.

- Indicate the amount of payment by filling in the '$ Amount' field. Make sure that all figures are accurate.

- For the 'Date payment check needed' section, specify when the payment is required by to ensure timely processing.

- In the 'Quantity', 'Description', 'Price per unit', and 'Total cost' fields, provide the necessary details of each item or service being requested for payment.

- Complete the 'Foreign National Tax Information' section based on the individual’s status, ensuring that all fields are correctly filled out as per requirements.

- Fill out the 'Complete vendor name and address including zip' section to ensure the payment can be directed to the correct recipient.

- Sign the form where indicated as the person making the requisition and obtain the necessary approving signature from the department head.

- Once all fields are completed, save changes to the form, then download, print, or share it as required to submit to Financial Services.

Begin completing the PAYMENT REQUEST FORM Foreign National online to streamline your payment request process.

Related links form

The withholding agent or payer is responsible for providing the 1042-S form. This could be employers, financial institutions, or other entities that make payments to foreign nationals. If you have used the PAYMENT REQUEST FORM Foreign National, stay in contact with your payor to ensure you receive the necessary documentation promptly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.