Get Clarification Of Income/support Statement - Financial Aid

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CLARIFICATION Of INCOME/SUPPORT STATEMENT - Financial Aid online

Filling out the CLARIFICATION Of INCOME/SUPPORT STATEMENT is an important step in the financial aid process. This guide provides detailed instructions to help you accurately complete the form online, ensuring that your financial aid application is comprehensive and valid.

Follow the steps to successfully complete your financial aid clarification form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

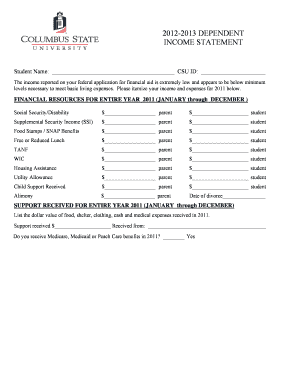

- Start by entering the student name and CSU ID at the top of the form. This information will help identify the financial aid application.

- In the section labeled ‘Financial Resources for Entire Year 2011,’ itemize all sources of income for both the parent and student. Fill in the income amounts as follows: list amounts received from Social Security/Disability, Supplemental Security Income (SSI), Food Stamps/SNAP Benefits, Free or Reduced Lunch, TANF, WIC, Housing Assistance, Utility Allowance, Child Support Received, and Alimony.

- Next, move to the ‘Support Received for Entire Year 2011’ section. Enter the dollar value of support such as food, shelter, clothing, cash, and medical expenses. Specify who provided this support.

- Indicate whether you received Medicare, Medicaid, or Peach Care benefits in 2011, by checking the appropriate box.

- Document any additional assistance received by listing the value of bills paid on your behalf by others or agencies and indicate the source.

- Proceed to the ‘Expenses for Entire Year 2011’ section. Estimate your typical yearly expenses for necessities like food, housing, utilities, transportation, medical, and clothing.

- Finally, review all the information to ensure its accuracy. Sign the form in the designated spaces for both the student and parent, and include the date of signing.

- Once completed, you can save changes, download, print, or share the form as needed to return it to the Financial Aid Office.

Complete your CLARIFICATION Of INCOME/SUPPORT STATEMENT online today to ensure your financial aid application is processed efficiently.

If your income changes after submitting the FAFSA, it is essential to update your application as soon as possible. You can contact your school’s financial aid office to discuss your situation and provide updated information. This is particularly important for ensuring that the CLARIFICATION Of INCOME/SUPPORT STATEMENT - Financial Aid reflects your current financial status. Uslegalforms can support you in making any necessary updates easily.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.