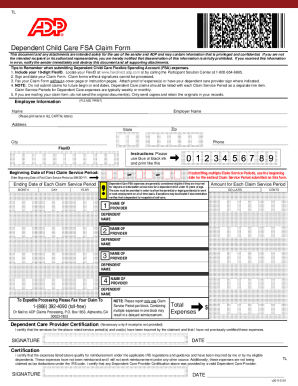

Get Adp Dependent Child Care Fsa Claim 2011-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign ADP Dependent Child Care FSA Claim online

How to fill out and sign ADP Dependent Child Care FSA Claim online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Locating a certified expert, scheduling a consultation, and visiting the office for a personal meeting makes completing an ADP Dependent Child Care FSA Claim from beginning to end tiring.

US Legal Forms enables you to swiftly create legally enforceable documents based on pre-designed online templates.

Obtain a swiftly generated ADP Dependent Child Care FSA Claim without needing to consult professionals. Over 3 million users are already benefiting from our distinctive repository of legal documents. Join us today and gain access to the premier collection of online templates. Experience it yourself!

- Locate the ADP Dependent Child Care FSA Claim you require.

- Access it with a cloud-based editor and start modifying.

- Complete the empty fields; names of involved parties, addresses, and contact numbers, etc.

- Personalize the fields with unique fillable options.

- Enter the specific date and affix your electronic signature.

- Click Done after verifying all the information.

How to Modify Get ADP Dependent Child Care FSA Claim 2011: personalize documents online

Place the appropriate document management functionalities at your command. Finalize Get ADP Dependent Child Care FSA Claim 2011 with our reliable tool that merges editing and eSignature capabilities.

If you aim to process and authenticate Get ADP Dependent Child Care FSA Claim 2011 online effortlessly, then our cloud-based option is the perfect choice. We provide an extensive template-based library of ready-to-complete documents that you can adjust and fill out online. Additionally, there’s no need to print the document or rely on external options to make it fillable. All the necessary features will be accessible to you as soon as you open the file in the editor.

Let’s explore our online editing functionalities and their primary features. The editor has an intuitive interface, so it won't require much time to master how to utilize it. We’ll examine three key sections that enable you to:

In addition to the functionalities mentioned previously, you can secure your file with a password, add a watermark, convert the document to the necessary format, and much more.

Our editor simplifies completing and authenticating the Get ADP Dependent Child Care FSA Claim 2011. It enables you to perform nearly every task related to handling forms. Furthermore, we consistently ensure that your experience in modifying files is safe and adheres to essential regulatory standards. All these aspects enhance the enjoyment of utilizing our solution.

Obtain Get ADP Dependent Child Care FSA Claim 2011, make the required revisions and adjustments, and download it in your preferred file format. Give it a go today!

- Alter and comment on the template

- The upper toolbar contains tools that assist you in emphasizing and obscuring text, excluding graphics and graphic elements (lines, arrows, and checkmarks, etc.), affix your signature, initialize, date the document, and more.

- Organize your documents

- Utilize the left toolbar if you wish to rearrange the document or delete pages.

- Render them shareable

- If you wish to make the template fillable for others and distribute it, you can employ the tools on the right and insert various fillable fields, signature and date fields, text boxes, etc.

No, amounts shown in box 14 of your W-2 for the ADP Dependent Child Care FSA Claim do not count as income. Instead, they reflect your contributions, which help you maximize savings on taxes. It is crucial that you understand this distinction when filing your tax returns.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.