Get 2012 Student Tax Non-filer Certification Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2012 Student Tax Non-Filer Certification Form online

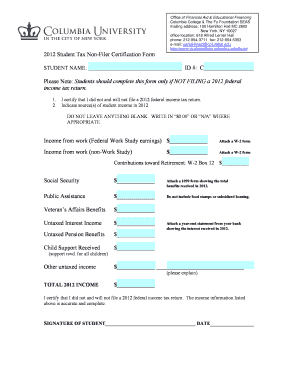

Filling out the 2012 Student Tax Non-Filer Certification Form is an essential task for students who are not filing a federal income tax return for the year 2012. This guide will walk you through each section of the form, ensuring you have the information needed to complete it accurately and efficiently.

Follow the steps to complete the form.

- Press the ‘Get Form’ button to access the document and open it for editing.

- In the designated field, input your name and ID number. Ensure that these details match the records at your educational institution.

- Read the instructions carefully. You must only complete this form if you did not file a 2012 federal income tax return.

- In the income section, accurately indicate all sources of income you received in 2012. Be sure to fill in zeros or 'N/A' where applicable.

- For each source of income listed (such as Federal Work Study earnings, non-Work Study income, Social Security, etc.), provide the dollar amount earned. If applicable, attach the necessary W-2 or 1099 forms that support your reported income.

- For total income, sum up all reported figures from the income sources provided and enter it in the 'TOTAL 2012 INCOME' field.

- Sign and date the certification statement at the bottom of the form, confirming that the information provided is accurate and complete.

- After thoroughly reviewing your form for accuracy, save your changes. You can also download, print, or share the completed document as needed.

Complete your documents online to ensure a smooth filing experience.

filer is someone who does not meet the income threshold set by the IRS and is not required to submit a tax return. This category often includes college students who have little to no income, allowing them to complete the 2012 Student Tax NonFiler Certification Form. Determining your status as a nonfiler is essential for effective financial planning and for accessing federal financial aid. Platforms like USLegalForms help guide users through the qualifying criteria.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.