Loading

Get Withholding Tax Forms 2017 - 2018 - Current Period - Department Of ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

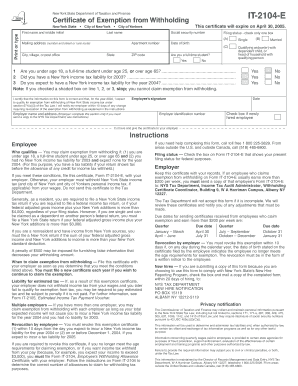

How to fill out the Withholding Tax Forms 2017 - 2018 - Current Period - Department Of ... online

Filling out the Withholding Tax Forms can be straightforward if you approach it step by step. This guide aims to provide clear and comprehensive instructions to help you complete the form accurately and efficiently online.

Follow the steps to fill out the Withholding Tax Forms online

- Click the ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Begin by entering your personal information, including your first name, middle initial, and last name.

- Provide your mailing address, city, state, and ZIP code. Ensure that the information is accurate to avoid issues with communication.

- Enter your Social Security number in the designated field.

- Select your filing status by checking only one box: Single, Married, or Qualifying widow(er)/head of household.

- Indicate whether you are a full-time student by selecting yes or no.

- Answer the questions regarding age and income tax liability by checking yes or no in the specified fields.

- Review your responses to confirm they align with the exemption qualifications as outlined in the instructions.

- Sign and date the form in the appropriate fields to certify that all information is correct.

- If you are the employer, complete the employer information section and keep the certificate for your records.

- Once completed, save your changes, and you may choose to download, print, or share the filled form as needed.

Get started on completing your Withholding Tax Forms online today!

Choosing between claiming 1 or 0 on your tax forms depends on how you want your tax situation to unfold. Claiming 0 will maximize withholding, possibly resulting in a refund, while claiming 1 will reduce current withholding, potentially leading to a tax bill at year's end. Analyzing your income and expenses can guide you to make the most informed choice for your financial circumstances.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.