Loading

Get Form W-4 - Web Ccis

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Form W-4 - Web Ccis online

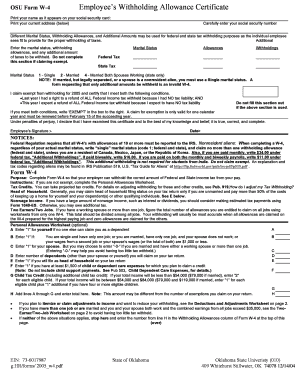

Filling out the Form W-4 effectively is crucial for ensuring that the correct amount of federal and state income tax is withheld from your pay. This guide provides step-by-step instructions to help you navigate the process smoothly, regardless of your prior experience with tax forms.

Follow the steps to accurately complete the Form W-4 - Web Ccis online.

- Click ‘Get Form’ button to access and open the form in the editor.

- In the first section, print your name exactly as it appears on your Social Security card. Next, enter your current address clearly below this line.

- Carefully input your Social Security number. Accuracy is important to avoid any issues with your tax records.

- Select your marital status from the provided options. You can choose ‘Single,’ ‘Married,’ or ‘Married Both Spouses Working’ if applicable.

- Determine the number of withholding allowances you wish to claim based on your situation. These allowances will help calculate how much tax should be withheld.

- If you claim exemption from withholding, ensure you meet the required conditions and write ‘EXEMPT’ in the designated box. Remember, this exemption is valid only for one calendar year.

- Sign and date the form at the bottom, affirming that this information is accurate to the best of your knowledge.

- Once all entries are complete, you can save changes to the form, download it for your records, print it out, or share it as needed.

Complete your Form W-4 - Web Ccis online now to ensure your tax withholding is accurate and efficient.

Filling out the new W-4 form is straightforward. Start by entering your personal information at the top. Then, follow the instructions for claiming dependents and any additional income, adjustments, or deductions. If you need guidance, USLegalForms provides useful resources to help you accurately complete Form W-4 - Web Ccis.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.