Loading

Get 2013-2014 Low Income Statement Do Not Leave Any Line On This Form Blank - Ccu

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2013-2014 LOW INCOME STATEMENT DO NOT LEAVE ANY LINE ON THIS FORM BLANK - Ccu online

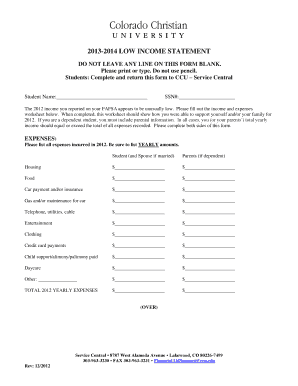

This guide provides a detailed walkthrough for completing the 2013-2014 Low Income Statement. Each section will be explained thoroughly to assist users in submitting their information accurately and completely.

Follow the steps to fill out the form accurately.

- Click the ‘Get Form’ button to access the form and open it in the editing interface.

- Begin by filling in your name and Social Security Number (SSN) in the designated fields at the top of the form. Ensure that this information is accurate, as it will be vital for processing your submission.

- In the income and expenses worksheet section, list your total yearly expenses for 2012. Include all relevant categories such as housing, food, and transportation. Make sure to enter the amounts for both yourself and any parents if you are a dependent student.

- Next, proceed to the income section. Document all sources of income received in 2012. This includes earnings from jobs, unemployment compensation, and any other financial resources. Again, ensure that you provide yearly totals.

- Double-check that all entries reflect yearly amounts and that you have completed every section without leaving any line blank.

- Once you have filled out both sides of the form, read through the certification statement. By signing, you affirm that the information is complete and accurate to the best of your knowledge.

- Finally, save any changes made to the form, and then utilize the available options to download, print, or share the completed document as needed.

Complete your documents online and submit your application today to ensure prompt processing.

Related links form

Schedule 3 is used to report additional income, such as capital gains, certain deductions, and tax credits. These items can play a pivotal role in determining your overall tax liability. When you're completing the 2013-2014 LOW INCOME STATEMENT DO NOT LEAVE ANY LINE ON THIS FORM BLANK - Ccu, be thorough in detailing the items that apply to your financial circumstances on Schedule 3.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.