Get Wi Cred1943 2016-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WI CRED1943 online

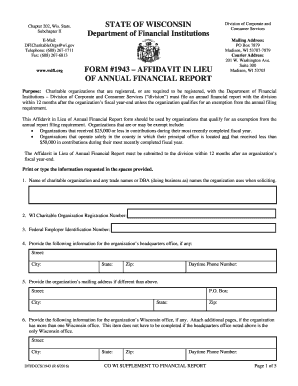

Completing the WI CRED1943 form online is essential for charitable organizations that qualify for an exemption from filing an annual financial report. This guide provides step-by-step instructions to help you navigate the process effectively and ensure that all required information is accurately submitted.

Follow the steps to complete the WI CRED1943 form online.

- Press the ‘Get Form’ button to access the WI CRED1943 form. This will allow you to fill out the module directly in your browser.

- Begin filling in the form by entering the name of the charitable organization, including any trade names or 'doing business as' (DBA) names that the organization uses when soliciting contributions.

- Provide the organization's Wisconsin Charitable Organization Registration Number. If you do not have this number, it is necessary to verify your registration with the relevant authorities.

- Enter the Federal Employer Identification Number (EIN) for the organization. This number is essential for tax purposes and can be obtained from the IRS if needed.

- Fill in the information of the organization’s headquarters office, including the street address, city, state, and zip code. Also include the daytime phone number for this office.

- If the organization has a mailing address different from the headquarters, provide that street address, P.O. Box (if applicable), city, state, and zip code.

- If applicable, list the information for each Wisconsin office that the organization possesses. Ensure to attach additional pages if there are multiple offices.

- Detail the information of the person(s) who have custody of the organization's financial records. Include first name, last name, city, state, street address, zip code, and daytime phone number.

- Record the details of the individual(s) within the organization who have final responsibility for the custody of contributions, using the same fields as described in the previous step.

- Fill out the details for the person who will respond to questions regarding this form, providing their first name, last name, street address, phone number, email, city, state, and zip code.

- Describe the charitable purpose(s) for which contributions will be utilized, or attach a supporting document that provides this information.

- Indicate whether a professional fundraiser was used in solicitations during the previous fiscal year by answering 'Yes' or 'No'. If 'Yes,' provide the details for each person affiliated with the fundraising.

- Respond to the questions regarding any changes to the previously submitted information and provide an explanation if applicable.

- State whether the organization is authorized by other authority to solicit contributions or whether its authority has been denied, suspended, or revoked.

- If the organization intends to accumulate a surplus rather than spending for stated purposes, include an explanation.

- Provide information on any grants or contributions made to organizations where board members have an interest, completing the details as necessary.

- Read the affidavit section carefully and complete the relevant affidavit that pertains to your organization, ensuring it is signed by the appropriate officers.

- Once all fields are completed, review the form for accuracy, save your changes, and select the options to download, print, or share the completed form if needed.

Complete your WI CRED1943 form online today to ensure compliance with your registration requirements.

In Wisconsin, new employees are required to fill out several vital forms. First, they must complete the W-4 form for tax withholding, and the I-9 form to verify identity and employment eligibility. Additionally, employers might ask for a WI CRED1943 form, which assists with compliance in employment regulations. Make sure you check with your employer for any specific requirements.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.