Loading

Get Address Change

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Address Change online

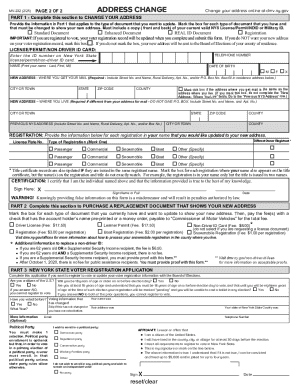

Changing your address is a necessary task for maintaining accurate records with the Department of Motor Vehicles. This guide provides step-by-step instructions to help you complete the Address Change form online efficiently.

Follow the steps to complete your Address Change form easily.

- Press the ‘Get Form’ button to access the Address Change form and open it in your preferred editor.

- In Part 1 of the form, fill in your personal information. This includes your name, date of birth, and identification number from your New York State driver license, learner permit, or non-driver ID card.

- Provide your new mailing address. Ensure it includes all necessary details such as street number, street name, city or town, state, and zip code.

- If your mailing address is different from where you reside, complete the 'New Address - Where You Live' section with the same thoroughness.

- Indicate your previous address and ensure it matches the information on file.

- If you desire to obtain a new document reflecting your new address, proceed to Part 2 to mark the applicable boxes for the types of documents you wish to update.

- Prepare your payment by writing a check or obtaining a money order made out to 'Commissioner of Motor Vehicles' for the required fee.

- Certify your application by signing in the 'Certification' section, ensuring that the information you provided is accurate to the best of your knowledge.

- Submit the completed form along with the payment and a copy of your current valid New York State License, Permit, or ID, to the address specified in the instructions.

- Keep your existing documents until you receive your new document in the mail. Alternatively, if you do not want a new document, simply fill out Part 1 and submit it to update your address without incurring any fees.

Start your Address Change process online today!

Yes, you need to notify the IRS of an address change. When you change your address, it's essential to update your information with the IRS to ensure you receive important tax documents and communications. You can easily notify them by filing Form 8822, which facilitates your address change. Keeping your tax records accurate ensures you stay compliant and avoid potential issues.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.