Loading

Get Retirement Salary Reduction Agreement - Carleton College

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Retirement Salary Reduction Agreement - Carleton College online

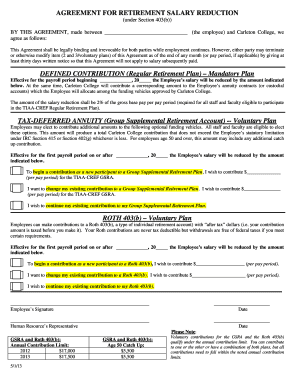

Completing the Retirement Salary Reduction Agreement is a crucial step toward securing your financial future. This guide will lead you through filling out the form online, ensuring that you understand each component and its significance.

Follow the steps to successfully complete the agreement.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your name in the blank space provided for the employee at the top of the agreement. Ensure that you use your full legal name as it appears in official documents.

- In the section titled 'Defined Contribution (Regular Retirement Plan) – Mandatory Plan,' indicate the effective date for the payroll period by filling in the date in the corresponding space.

- Specify the amount by which you wish to reduce your salary, which must be 2% of your gross base pay for this mandatory plan. This amount should be written in the designated space clearly.

- Moving on to the 'Tax-Deferred Annuity (Group Supplemental Retirement Account) - Voluntary Plan' section, you may choose to start a new contribution or change an existing one. If you are a new participant, indicate the amount you wish to contribute per pay period in the specified space.

- If you are changing your existing contribution to the Group Supplemental Retirement Plan, be sure to fill in the new amount you wish to contribute in the designated area.

- In the 'Roth 403(b) - Voluntary Plan' section, repeat the process from the previous steps: indicate your new or changed contribution. Specify the amount you wish to contribute per pay period in the appropriate field.

- Once all sections are completed, review your entries for accuracy. You must sign and date the agreement at the bottom, ensuring your signature matches the name you provided at the top.

- After finalizing the form, you can save your changes, download a copy for your records, print it out, or share the form as needed for submission.

Complete your Retirement Salary Reduction Agreement online today for a secure financial future.

The salary reduction pension plan designed for employers with 100 or fewer employees is commonly known as a Simple IRA plan. This plan allows small businesses to provide retirement benefits while simplifying administrative duties. Exploring options like the Retirement Salary Reduction Agreement - Carleton College can help small employers establish effective retirement solutions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.