Loading

Get Al Chapter 13 Plan 2014-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AL Chapter 13 Plan online

Completing the AL Chapter 13 Plan online can seem daunting, but with clear guidance, you can navigate through it with confidence. This guide will outline each section of the form to ensure you understand how to provide the necessary information accurately.

Follow the steps to fill out your AL Chapter 13 Plan smoothly.

- Press the ‘Get Form’ button to access the AL Chapter 13 Plan. This will open the form in your online editor for completion.

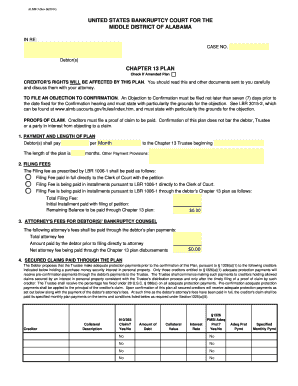

- Begin by filling out the case number and debtor(s) details at the top of the form. Ensure all information is accurate and up to date.

- Indicate if this is an amended plan by checking the appropriate box. This is important for record-keeping and processing.

- Section 1 requires you to state the monthly payment amount and the length of the plan. Clearly outline how much you intend to pay to the Chapter 13 Trustee each month and the total number of months for the plan.

- Next, proceed to Section 2 and detail the filing fees. Specify if the filing fee is paid in full, in installments, or through the Chapter 13 plan.

- In Section 3, declare the attorney's fees. Fill in the total attorney fee amount, what has been paid before filing, and the net attorney fee to be covered by the plan.

- Section 4 focuses on secured claims paid through the plan. List each creditor, collateral descriptions, and payment terms including interest rates.

- For Section 5, identify any long-term debts to be maintained through the plan, specifying monthly payments and collateral descriptions.

- Section 6 addresses any property you intend to surrender, detailing the collateral and associated debts.

- Move on to Section 7, where you need to outline defaults you plan to cure, which includes providing monthly payments and interest rates.

- In Section 8, identify any direct payments that will be made by you to secured creditors, providing the necessary details about the creditors and payments.

- Section 9 covers any prepetition domestic support obligations. Fill this out clearly to ensure proper handling of these claims.

- In Section 10, include details of any priority claims, such as the scheduled amounts and the payment plan.

- Sections 11 to 13 focus on executory contracts, specially classified unsecured claims, and general unsecured claims. Provide the required details as specified.

- Complete the final sections addressing other plan provisions, if any, and ensure all information is filled out thoroughly.

- Once you have filled out all sections, review the form for completeness and accuracy. After ensuring all information is correct, save your changes, and choose to download, print, or share your completed form as necessary.

Ready to complete your Chapter 13 Plan online? Start the process now!

Several factors can disqualify you from filing an AL Chapter 13 Plan. If your debts exceed the legal limits or if you have not completed the required credit counseling course, you may not qualify. Additionally, if you fail to make your required payments for a previous bankruptcy, this could impact your eligibility. It is wise to review your situation carefully and consult with an expert to explore your options.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.