Loading

Get Return To Rls Department Office

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Return To RLS Department Office online

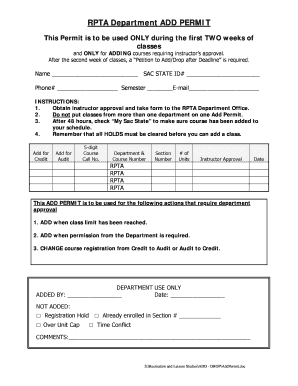

Completing the Return To RLS Department Office form is a crucial step for students looking to navigate their course registrations efficiently. This guide provides a comprehensive overview of the form's components and offers step-by-step instructions for successfully filling it out online.

Follow the steps to complete the form effectively.

- Click the ‘Get Form’ button to obtain the Return To RLS Department Office form and open it in your preferred online editor.

- Fill in your name, State ID number, phone number, and email address in the designated fields. Ensure all information is accurate.

- Indicate the semester for which you are requesting to add courses. This helps the department process your request efficiently.

- Obtain the necessary instructor approval before proceeding. This step is crucial as the form is intended for adding courses requiring instructor consent.

- Specify the details of the class you wish to add: enter the 5-digit course call number, department and course number, section number, and the number of units.

- Choose whether you want to enroll for credit or audit by selecting the appropriate option on the form.

- Once all fields are completed, review your entries for accuracy. Ensure you have cleared any holds that may impede your course registration.

- After submitting the form to the department, check your schedule in 'My Sac State' after 48 hours to confirm that the course has been added.

- Once you have verified that the form was processed, you may save, download, print, or share the form as needed.

Start completing your forms online today to ensure a smooth registration process!

Filing a tax return without records requires gathering as much information as possible, such as estimated income and allowable deductions. You may use bank statements, employer documents, or even previous tax returns as references. For additional support navigating this process, don’t hesitate to return to the RLS Department Office.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.