Loading

Get 13cal Grant E2.p65

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 13Cal Grant E2.p65 online

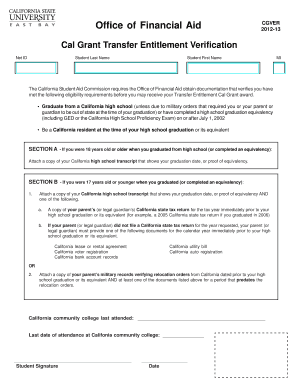

Filling out the 13Cal Grant E2.p65 form is an essential step for verifying your eligibility for the California Transfer Entitlement Cal Grant award. This guide provides clear, step-by-step instructions on how to complete the form efficiently and accurately.

Follow the steps to successfully complete the form online.

- Press the ‘Get Form’ button to obtain the form and open it in the digital editor.

- Begin by entering your Net ID in the specified field to identify your application.

- Fill in your last name and first name as they appear on your official documentation.

- Review the eligibility requirements outlined at the top of the form to ensure you meet the criteria for the Transfer Entitlement Cal Grant award.

- Proceed to SECTION A if you were 18 years old or older at the time of high school graduation or equivalency. Attach a copy of your California high school transcript showing the graduation date or equivalent proof.

- If you were 17 years old or younger when graduating, move to SECTION B. Attach your high school transcript or equivalency proof along with one of the required parent or guardian documents listed.

- Complete the section concerning your California community college attendance, entering the name of the last attended college and the last date of attendance.

- Sign the form where indicated. Ensure your signature matches the name provided.

- Enter the date of your signature in the designated field.

- Once you have filled out all necessary sections and attached any required documentation, save your changes, and download or print the completed form for your records.

Take the next step and complete your 13Cal Grant E2.p65 form online today!

No, you do not generally need to report the Cal Grant as income on your taxes. However, depending on how you use the grant, there could be specific circumstances that warrant a different approach. It's advisable to review any tax guidelines related to the 13Cal Grant E2.p65 or consult a tax expert to confirm.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.