Get Guidelines For Gift Processing - California State University, East Bay

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Guidelines For Gift Processing - California State University, East Bay online

Filling out the Guidelines for Gift Processing at California State University, East Bay is an essential step in ensuring that your generous contributions are properly documented and acknowledged. This guide provides a clear, step-by-step approach to completing the form online, making the process straightforward and accessible for all users.

Follow the steps to efficiently complete the Guidelines for Gift Processing form.

- Press the ‘Get Form’ button to access the Gift Processing Form and open it in your preferred online editor.

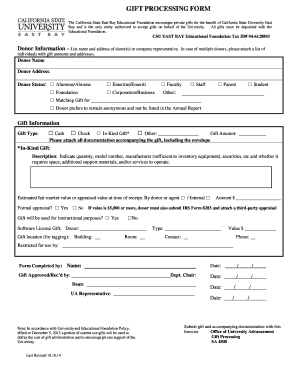

- Begin by entering the donor information. Provide the full name and address of the donor or their company representative. If there are multiple donors, prepare a separate list detailing each individual’s gift amount and address.

- Specify the donor's status by selecting the appropriate checkbox: Alumnus/Alumna, Emeritus/Emeriti, Faculty, Staff, Foundation, Corporation/Business, or other. Indicate if the donor prefers to remain anonymous and not be mentioned in the Annual Report.

- In the gift information section, choose the gift type by marking the corresponding checkbox: Cash, Check, Parent, Student, or an In-Kind Gift. If applicable, provide additional details and specify any other relevant gift type.

- Enter the total gift amount. Ensure to attach any supporting documentation related to the gift, including the envelope.

- For In-Kind Gifts, provide a description that includes quantity, model number, and manufacturer details. Indicate if the gift requires any additional support materials or space to operate.

- Detail the estimated fair market value or appraised value at the time of receipt and indicate who has provided this valuation. Check 'Yes' or 'No' if a formal appraisal is included.

- If the gift value is $5,000 or more, ensure that the donor submits IRS Form 8283 along with a third-party appraisal.

- Indicate whether the gift will be used for instructional purposes by selecting 'Yes' or 'No'.

- For software license gifts, fill in the donor information, gift location for tagging, amount, building, type, room, and contact information.

- Complete the form by entering the name of the person who filled it out, and secure the necessary approvals by having it signed by the Department Chair, Dean, and UA Representative.

- Finally, submit the completed form along with all accompanying documentation to the Office of University Advancement, Gift Processing, SA 4800.

Complete the Guidelines for Gift Processing form online today to ensure your contributions are properly processed.

In California, there is no state-imposed limit on gifts, although certain financial implications apply to gifts over $17,000, which may affect tax obligations. For gifts below this threshold, the Guidelines For Gift Processing - California State University, East Bay provide essential information on compliance and reporting procedures. It's crucial to stay informed about these limits to avoid potential issues with regulations.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.