Loading

Get Cat-d Form G-21 2003-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CAT-D Form G-21 online

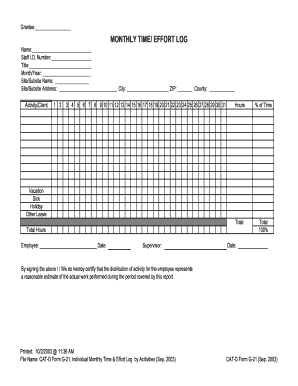

The CAT-D Form G-21 serves as an essential monthly time and effort log for individuals documenting their work activities. This guide provides step-by-step instructions to assist users in completing the form accurately and efficiently online.

Follow the steps to fill out the CAT-D Form G-21 online.

- Press the ‘Get Form’ button to acquire the document and open it in your preferred editor.

- Enter your grantee name in the designated space at the top of the form.

- Fill in your name, staff identification number, and job title in the respective fields.

- Specify the month and year for which you are reporting your activities.

- Identify the site or subsite name and fill in the corresponding address details, including city, ZIP code, and county.

- In the activity/client section, input your activities across the numbered fields, up to 31 entries.

- Record the hours spent on each activity and the percentage of time each activity represents.

- Ensure the total hours add up to 100%.

- Document any vacation, sick, holiday, or other leave in the appropriate sections, ensuring to total these hours.

- Find the employee and supervisor signature fields and sign and date them appropriately.

- Upon completing the form, you can save your changes, download a copy, print it, or share it as needed.

Complete your documents online with confidence!

You need to file Schedule D if you have sold any stocks, bonds, mutual funds, or other capital assets within the tax year. If you experienced any capital gains or losses during these transactions, this form becomes necessary. It's crucial to review your financial activities to determine your filing obligations. Resources such as the CAT-D Form G-21 on uslegalforms can help guide you through the process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.