Loading

Get Mi Form 5082 2015-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI Form 5082 online

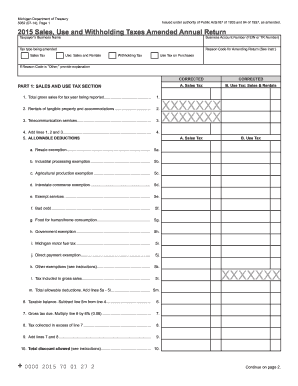

Filling out the MI Form 5082 is an important step in managing your sales, use, and withholding taxes for the state of Michigan. This guide will provide you with detailed, user-friendly instructions to help you complete the form accurately and efficiently online.

Follow the steps to fill out MI Form 5082 online:

- Click ‘Get Form’ button to obtain the MI Form 5082 and access it in your online editor.

- Begin by entering your taxpayer’s business name and business account number (FEIN or TR Number) at the top of the form.

- Indicate the tax type being amended and provide the reason code for amending the return as specified in the instruction section.

- In Part 1, enter the total gross sales for the tax year being reported. Also, fill in the additional revenue streams like rental of tangible property and telecommunication services.

- Calculate total allowable deductions by adding up the relevant exemptions listed in lines 5a to 5l. Be sure to keep records supporting your claims.

- Determine the taxable balance by subtracting the total allowable deductions (line 5m) from the total gross sales (line 4).

- Calculate the gross tax due by multiplying the taxable balance (line 6) by the applicable tax rate of 6% (0.06).

- Enter any tax collected in excess of the calculated gross tax due.

- Complete the rest of Part 1 by summing the relevant lines to arrive at the total tax due and any payments made.

- Move on to Part 2 and enter the total amount of taxable purchases, then calculate the use tax payments.

- Continue to Part 3, where you will provide information on withholding tax, including gross payroll and income tax withheld.

- In the summary section (Part 4), calculate any overpayments, total taxes due, and amount paid originally.

- Finally, complete the signature section. Print the form, sign it, and date it as required. You can save changes, download, or share your completed form.

Complete the MI Form 5082 online today to ensure your amendments are processed efficiently.

To fill out a withholding allowance form, begin by carefully reading the instructions provided with the form. You will need to provide information about your income, filing status, and any allowances you wish to claim. Accurate completion ensures your employer withholds the right amount of taxes. Utilizing services from uslegalforms can help you navigate this task confidently.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.