Loading

Get Tax Exemption Application For Tuition Fee Waiver.pdf

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tax Exemption Application For Tuition Fee Waiver.pdf online

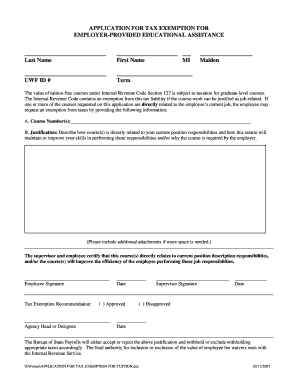

Filling out the Tax Exemption Application For Tuition Fee Waiver form online can streamline the process of requesting tax exemption for employer-provided educational assistance. This guide offers clear steps to help users complete the form accurately and efficiently.

Follow the steps to fill out your application correctly.

- Press the ‘Get Form’ button to access the Tax Exemption Application For Tuition Fee Waiver form and open it in your preferred online viewer.

- Enter your last name, first name, and middle initial in the designated fields to identify yourself clearly.

- Input your UWF ID number to ensure your application is linked to your student profile.

- Specify the term for which you are applying for the tax exemption, indicating the relevant academic period.

- If applicable, provide your maiden name in the specified field to maintain consistency with past records.

- List the course numbers for the courses for which you are requesting a tax exemption in the provided space.

- In the justification section, thoroughly describe how the listed course(s) relate directly to your current job responsibilities. Explain how this coursework will help maintain or improve your job performance.

- If you require more space for your justification, attach additional documents as necessary.

- Both the employee and supervisor must sign the application to certify the validity of the request concerning job responsibilities.

- Indicate the date the application is signed to mark the official submission date.

- Your application will now be reviewed, and the agency head or designee will indicate approval or disapproval of your tax exemption request.

- Finally, save changes to the document, and download or print a copy for your records. You may also share the completed application as necessary.

Complete your Tax Exemption Application online today and ensure you maximize your educational benefits.

The taxable portion is reported as wages on line 1 of IRS Form 1040. Also write the letters “SCH” and the taxable amount of your scholarships, grants or tuition waivers on the dotted line next to line 1.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.