Loading

Get Non-resident Alien Data Collection Form - University Of Utah

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Non-Resident Alien Data Collection Form - University Of Utah online

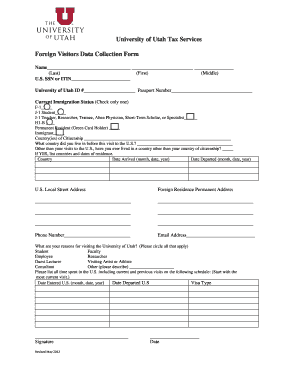

The Non-Resident Alien Data Collection Form is crucial for individuals visiting the University of Utah from abroad. This guide provides clear instructions to help users fill out the form accurately and efficiently online.

Follow the steps to successfully complete the form online.

- Press the ‘Get Form’ button to access the form and open it in your preferred editor.

- Begin by providing your name in the designated fields, including your last name, first name, and middle name.

- Enter your U.S. Social Security Number or Individual Taxpayer Identification Number in the corresponding section.

- Include your University of Utah identification number and passport number in the provided spaces.

- Indicate your current immigration status by checking the appropriate box from the options listed (F-1, J-1, H1-B, etc.).

- List the country or countries of your citizenship in the allocated section.

- Provide information on the country where you lived before coming to the United States.

- If applicable, answer the question regarding previous residences outside your country of citizenship by indicating 'Yes' or 'No' and, if 'Yes,' listing the countries and dates of residence.

- Complete your U.S. local street address and your foreign residence permanent address in the spaces provided.

- Fill in your phone number and email address to ensure proper communication.

- Specify your reasons for visiting the University of Utah by circling all applicable options (e.g., student, faculty, researcher, etc.).

- List all periods spent in the U.S. by noting the dates you entered and departed the U.S., along with your visa type.

- Sign and date the form at the bottom to certify the information provided is accurate.

- Review the completed form for any errors or missing information, then save your changes, download, print, or share the form as needed.

Complete the Non-Resident Alien Data Collection Form online today to ensure a smooth process for your visit.

Tax treatment of nonresident alien If you are not engaged in a trade or business, the payment of U.S. source income that is fixed, determinable, annual, or periodical is taxed at a flat 30 percent (or lower treaty rate) and no deductions are allowed against such income.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.