Loading

Get Alliant Consulting Contractor Fringe Benefit Statement

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Alliant Consulting Contractor Fringe Benefit Statement online

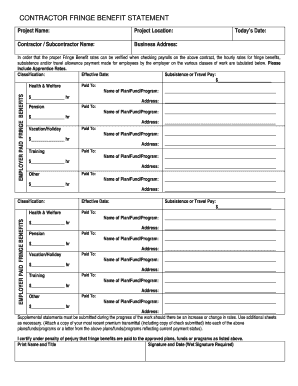

Filling out the Alliant Consulting Contractor Fringe Benefit Statement is an essential step for contractors to document employee benefit contributions accurately. This guide will walk you through the process of completing the form online with clarity and ease.

Follow the steps to complete the Alliant Consulting Contractor Fringe Benefit Statement online

- Click ‘Get Form’ button to obtain the form and open it in the editor. This action allows you to access the required document for completion.

- Begin by inputting the project name in the designated field. This information identifies the specific project related to the fringe benefits.

- Next, fill in the project location. Providing this detail ensures accurate records for compliance and verification purposes.

- Enter the contractor or subcontractor name in the designated space. This identifies the organization responsible for the payment of fringe benefits.

- Complete the business address of the contractor or subcontractor. A precise address allows for effective communication regarding the submitted information.

- In the section for today's date, input the current date when you are completing the form to provide a timestamp for the submission.

- Fill out the employer-paid fringe benefits section by listing the effective date and classification for each benefit. Provide the names of benefit plans, their addresses, and the corresponding hourly rates for health and welfare, pension, vacation/holiday, training, and any other applicable benefits.

- Ensure that subsistence or travel pay amounts are clearly documented under the specified areas, indicating who the payments are made to.

- Review all entries for accuracy, ensuring that all fields are filled correctly. Accuracy is critical for compliance and verification.

- If there are any changes in rates during the work progression, submit supplemental statements as necessary and attach recent premium transmittals or letters reflecting current payment status.

- Finally, provide your printed name and title in the certification section, sign and date the form where indicated. Remember, a wet signature is required.

- Once all information is complete and accurate, save the changes, and choose to download, print, or share the form as required.

Complete your Alliant Consulting Contractor Fringe Benefit Statement online today for efficient and compliant documentation.

Documenting fringe benefits involves keeping accurate records of what benefits you provide and to whom. This documentation should be clear and maintained consistently. By using the Alliant Consulting Contractor Fringe Benefit Statement, you can ensure your records are thorough and compliant with necessary regulations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.