Loading

Get Tsp-76 2005

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TSP-76 online

The TSP-76 form is essential for individuals seeking a financial hardship in-service withdrawal from their Thrift Savings Plan account. This guide provides detailed, step-by-step instructions to help users complete the form accurately and efficiently.

Follow the steps to successfully complete the TSP-76 online.

- Click ‘Get Form’ button to obtain the TSP-76 form and open it in the editing interface.

- In Section I, provide your personal information, including your last name, first name, middle initial, social security number, address, and daytime phone number.

- Move to Section II, where you will specify the amount you are requesting for withdrawal. Ensure that this amount is at least $1,000 and does not exceed the amount necessary to address the hardship.

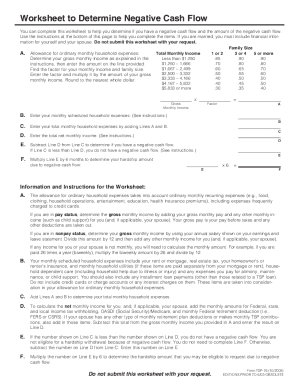

- In Section II, Item 9, check all applicable reasons for your financial hardship, such as negative cash flow, medical expenses, legal expenses, or personal casualty loss.

- Proceed to Section III to provide spouse information if you are married. Fill in your spouse's name and social security number, if applicable.

- If you are a married participant in CSRS or FERS, complete Section IV or V respectively to obtain your spouse's consent. This requires your spouse’s signature and notarization.

- In Section VI, if you wish to have the funds directly deposited, fill in your financial institution's routing number and account number. Specify whether it is a checking or savings account.

- Finally, review and certify your information in Section VII. Sign and date the form to affirm that you have accurately represented your financial hardship.

- After completing the form, save your changes. You can then download, print, or share the document as needed.

Complete your TSP-76 form online today to address your financial hardship efficiently.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

TSP basic on your paycheck refers to the amount deducted as contributions to your Thrift Savings Plan. This deduction helps pave the way for future financial stability during retirement. If you want clear insights into your deductions and TSP-76, consider exploring tools and resources through the uslegalforms platform.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.