Get Titlemaxllc Certification For No Information Reporting On The Sale Or Exchange Of A Principal Residence

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TitleMaxLLC Certification for No Information Reporting on the Sale or Exchange of a Principal Residence online

The TitleMaxLLC Certification for No Information Reporting on the Sale or Exchange of a Principal Residence is an essential document for sellers to complete accurately. This guide provides a step-by-step approach to filling out the form online, ensuring users can navigate the process with confidence.

Follow the steps to complete the certification form successfully.

- Press the ‘Get Form’ button to access the certification form and open it for editing.

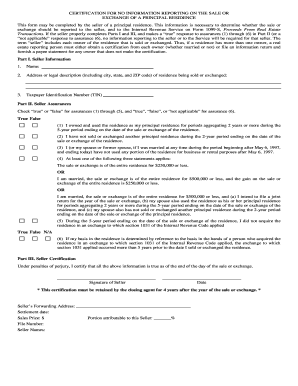

- In Part I, enter your personal information as the seller. Fill in your name, the address or legal description of the residence being sold or exchanged, and your Taxpayer Identification Number (TIN).

- Move to Part II and provide your assurances by checking ‘true’ or ‘false’ for assurances 1 through 5, and ‘true’, ‘false’, or ‘not applicable’ for assurance 6. Ensure your responses accurately reflect your situation regarding the sale.

- In Part III, complete the seller certification. Confirm that all information provided is true. Sign the form and date it at the designated spots.

- Finally, review your form for completeness and accuracy. You can then save changes, download the completed form, print it, or share it as necessary.

Complete your TitleMaxLLC Certification online today for a seamless selling experience.

This certification confirms that the sale or exchange of your principal residence does not require information reporting to the IRS. It simplifies your responsibilities and streamlines your tax filing process. Using the TitleMaxLLC Certification for No Information Reporting on the Sale or Exchange of a Principal Residence can provide you peace of mind knowing that you are compliant without the hassle of additional documentation.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.