Loading

Get Tiaa Cref F11379 2014-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TIAA CREF F11379 online

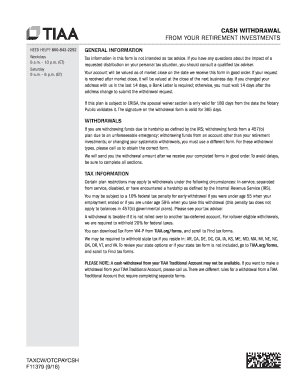

This guide provides step-by-step instructions on how to complete the TIAA CREF F11379 form for cash withdrawals from your retirement investments. By following these guidelines, you can smoothly navigate through the form and ensure your requests are processed efficiently.

Follow the steps to fill out the TIAA CREF F11379 form seamlessly.

- Press the 'Get Form' button to access the TIAA CREF F11379 form and open it for completion.

- Enter your personal information in section 1, including your first name, last name, social security number, contact telephone number, state of legal residence, and citizenship status.

- Provide your contract numbers in section 2. This includes the TIAA number, plan number, and sub plan number.

- If applicable, detail your annuity loan repayment options in section 3. Choose whether to pay off total outstanding loan balances or not.

- Complete section 4 regarding Roth accumulations, indicating if you have Roth contributions and which portions you are withdrawing.

- If you are over 70½ years old, fill out section 5 to confirm if the withdrawal is to satisfy IRS-required minimum distributions.

- In section 6, specify your federal tax withholding preferences for your withdrawal.

- Choose the withdrawal amount in section 7, either the entire amount or a specified portion, and complete section 8 to indicate how much to withdraw from investments.

- If opting for systematic withdrawals, specify the frequency and start date in section 9.

- In section 10, provide payment instructions, including direct deposit options to your existing or new bank account.

- Sign and date the authorization section in step 11, confirming your consent for TIAA to process your withdrawal.

- Complete section 12 only if you are unmarried, certifying your status accordingly.

- If married, your spouse must complete section 13, including their waiver of survivor benefits.

- Ensure your employer's plan representative completes any necessary signatures in section 14 for employer authorization.

- Review your completed form, make sure all required documents are included, then save changes or print the form as needed.

Complete your form online to streamline your cash withdrawal process.

You can upload files to TIAA CREF F11379 through the secure online portal. Simply log into your account and look for the document upload feature. This allows for streamlined communication and document submission, making it easier for you to manage your finances.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.