Loading

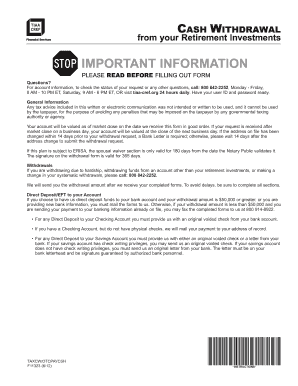

Get Tiaa Cref F11323 2011-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TIAA CREF F11323 online

Filling out the TIAA CREF F11323 form online is a straightforward process that allows users to manage their retirement investments conveniently. This guide provides step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to fill out the TIAA CREF F11323 form online.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Begin with section one where you will fill in your personal information. Ensure all details such as your name, social security number (SSN), and state of legal residence are accurate and printed clearly.

- In section two, indicate if you have any outstanding annuity loans. If you do, select the appropriate options based on whether you intend to repay the loan or not.

- Proceed to section three where you will specify if you have any Roth accumulations. If applicable, answer the questions regarding your request for non-Roth or Roth accumulations.

- In section four, indicate your requirements for mandatory distributions if applicable. Check the necessary boxes and if you are married, provide your spouse’s information.

- Move on to section five where you will determine your tax withholding preferences. Specify if you prefer no withholding, default federal withholding, or any other option specific to your situation.

- In section six, select the amount you wish to withdraw. You can opt to withdraw the entire available amount, a portion, or set up systematic withdrawals. Provide the dollar amount or percentage as required.

- Next, in section seven, indicate the specific accounts or funds from which you wish to withdraw the amount stated in the previous step.

- In section eight, specify your delivery instructions for receiving funds. Choose between direct deposit options or receiving funds via check.

- Sign the form in section ten, authorizing TIAA CREF to process your request and verifying your taxpayer identification number.

- If required, have your employer’s plan representative complete section eleven. This involves confirming your eligibility for withdrawal.

- Finally, review the checklist in section twelve, ensure all documents are completed, and send your completed forms package to the appropriate address depending on your delivery choice.

Complete your TIAA CREF F11323 form online to manage your retirement investments today.

Related links form

To locate your tax forms online, log into your TIAA account and look for the 'Tax Forms' section. All relevant forms, including your forms related to your TIAA CREF F11323 account, can usually be accessed here. If you have trouble finding them, TIAA’s customer support is available to assist you in retrieving your documents.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.