Loading

Get Priority One Financial Service Credit Application 2014-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Priority One Financial Service Credit Application online

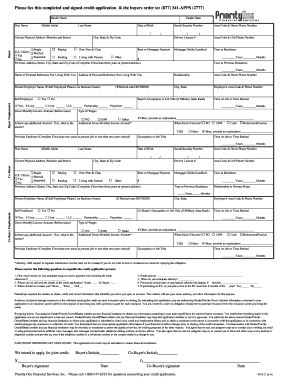

Completing the Priority One Financial Service Credit Application online is a straightforward process designed to gather essential information required for your credit request. This guide will assist you in filling out each section of the application accurately and efficiently.

Follow the steps to complete your credit application with ease.

- Press the ‘Get Form’ button to access the credit application document and open it in your editing tool.

- Begin by filling in your dealer name and personal details including first name, middle initial, last name, date of birth, and current physical address comprising the number and street, city, state, and zip code.

- Enter your social security number, area code, and home phone number, followed by your driver's license number and cell phone number.

- Indicate your living situation by selecting owning (free and clear), renting, or mortgage payment options. Provide your marital status and confirm if you are a U.S. citizen.

- If you have lived at your current address for less than three years, complete the previous address section with street, city, state, and zip code.

- List your mortgage holder or landlord, along with the length of time you have resided at your current address.

- Provide the name and contact details of a personal reference who does not live with you, along with your relationship to them.

- Fill out the employment information, including the name of your current employer, city, state, phone number, and how long you have been employed there.

- State your occupation or job title, and if self-employed, indicate the type of business structure (S Corp, C Corp, LLC, Partnership, Proprietor).

- Input your gross monthly income amount before taxes and disclose any additional income sources that apply.

- Complete any previous employment details required if applicable, repeating similar steps as above.

- If applicable, provide your co-buyer’s details, repeating the previous steps to gather their personal and employment information.

- Answer additional questions related to your anticipated down payment, preferred contact methods, and previous ownership of boats or recreational vehicles.

- Review the consent and disclosure section, ensuring you understand the authorizations provided by signing the document.

- Finalize your application by saving the changes, downloading the form, printing it, or sharing it as necessary.

Complete your application online today and take the next step toward securing your credit!

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.