Get Payoff Statement Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Payoff Statement Form online

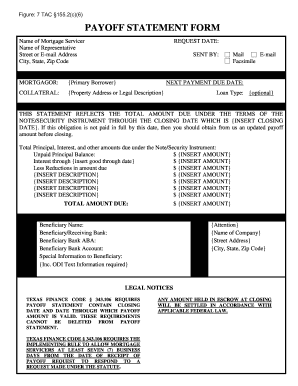

Filling out the Payoff Statement Form online is a straightforward process that helps individuals manage their mortgage obligations efficiently. This guide provides a step-by-step approach to ensure all required information is accurately entered.

Follow the steps to complete the Payoff Statement Form with ease.

- Click ‘Get Form’ button to obtain the Payoff Statement Form and open it for editing.

- Begin by entering the name of the mortgage servicer and the representative. This information is vital as it identifies the entity handling your mortgage account.

- Provide the street or email address, city, state, and zip code to ensure that any correspondence is directed appropriately.

- Fill in the request date and indicate how the form is sent, such as via mail, email, or facsimile. This documentation is essential for tracking the request.

- Enter the mortgagor's name in the loan information section, which reflects the primary borrower responsible for the mortgage.

- Specify the next payment due date. This date is crucial for understanding the timeline for payment.

- Detail the collateral by providing either the property address or legal description associated with the mortgage.

- If applicable, select the loan type; this section may be optional depending on your mortgage specifics.

- In the amount due section, indicate the total amount owed through the closing date specified. Input the unpaid principal balance and interest amounts accurately.

- Address additional reductions in the amount due, if applicable, by detailing each reduction's description and amount.

- Finally, review all entries for accuracy before submitting. You can save changes, download your completed form, print it for your records, or share it as needed.

Take action today by completing the Payoff Statement Form online to manage your mortgage effectively.

To request a payoff statement, contact your lender through their preferred communication method, which may include phone, email, or an online request form. Clearly state that you require a payoff statement, and provide any necessary information like your account number. By using the Payoff Statement Form, you can ensure that all pertinent details are included in your request, making it easier for your lender to assist you.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.