Get Mayer Malbin Credit Application & Personal Guarantee 2013-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mayer Malbin Credit Application & Personal Guarantee online

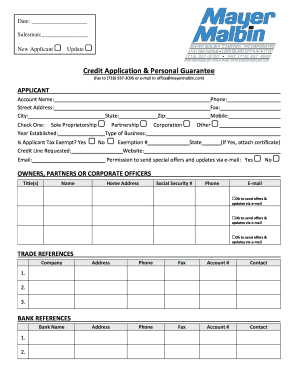

Filling out the Mayer Malbin Credit Application & Personal Guarantee online is a straightforward process that enables you to apply for credit efficiently. This guide will walk you through each section of the form thoroughly, ensuring you provide the necessary information accurately and comprehensively.

Follow the steps to complete your application smoothly.

- Click ‘Get Form’ button to access the application document and open it in your preferred editor.

- In the 'Applicant' section, fill in your account name, street address, city, state, zip code, and contact information including email and phone number. Select the type of business and indicate if you are tax exempt by checking 'Yes' or 'No'. If applicable, attach your tax exemption certificate.

- Provide information about the owners, partners, or corporate officers in the designated section. Include their titles, names, home addresses, social security numbers, phone numbers, and email addresses. Specify if you allow the company to send offers and updates via email for each individual.

- List three trade references by filling in the company name, address, phone number, fax number, account number, and contact person for each reference.

- Fill in your bank references with the bank name and any relevant details requested for two banks.

- In the 'Terms' section, review the payment terms and conditions outlined. Acknowledge your understanding by signing where indicated for the authorized representative, providing printed name, title, and date.

- Complete the 'Personal Guarantee' section by filling out the required information for Guarantors including signature, printed name, date, and social security number.

- Once all sections are completed, review your application for accuracy. You will then have the option to save changes, download, print, or share the form for submission.

Begin your online application today to streamline your credit request process.

An example of a personal guarantee could involve a business owner signing a credit application for their company, agreeing to make repayments from their personal income if the business can’t. For instance, when you fill out the Mayer Malbin Credit Application & Personal Guarantee, you might put your home or savings as collateral in case of default, offering lenders reassurance that you are committed to fulfilling your financial obligations.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.