Loading

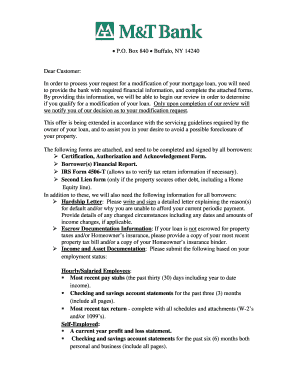

Get M&t Bank Foreclosure Prevention Package

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the M&T Bank Foreclosure Prevention package online

This guide offers clear instructions on completing the M&T Bank Foreclosure Prevention package online. By following these steps, users can effectively submit their request for mortgage modification and secure the assistance they need.

Follow the steps to complete your Foreclosure Prevention package.

- Press the ‘Get Form’ button to access the Foreclosure Prevention package and open it in your editor.

- Begin by filling out the Certification, Authorization and Acknowledgement Form. Ensure that all information provided is accurate. This includes your personal details and those of any co-borrowers.

- Complete the Borrower(s) Financial Report. Provide all requested information regarding income, expenses, and household composition. Make sure to confirm all amounts to ensure consistency.

- If applicable, fill out the IRS Form 4506-T to authorize the verification of your tax return information. Enter the necessary tax details and ensure the form is signed.

- Prepare a thorough hardship letter detailing the reasons for your mortgage difficulty. Include specific dates and amounts of any financial changes.

- If your loan is not escrowed for property taxes or homeowner's insurance, gather the required escrow documentation, such as recent property tax bills and insurance binders.

- Collect your income and asset documentation based on your employment status. This may include pay stubs, checking and savings statements, and your most recent tax return.

- Once the forms are completed, review them for accuracy. Make any necessary adjustments before finalizing.

- At the end, save your changes, and choose to download, print, or share the completed Foreclosure Prevention package online.

Take the first step towards mortgage assistance and complete your documents online today.

The proper way to fill out a deposit slip involves entering the date, account number, and the amounts being deposited. You should also list any checks separately with their respective amounts. Always review your deposit slip for any errors, as proper submissions help maintain your finances, especially if you are utilizing the M&T Bank Foreclosure Prevention package.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.