Loading

Get Kioti Finance Credit Application

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Kioti Finance Credit Application online

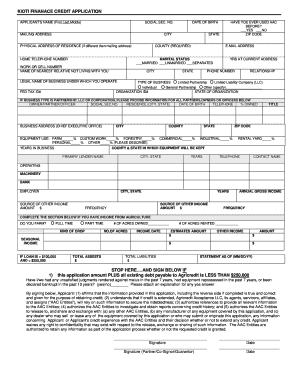

Filling out the Kioti Finance Credit Application online is a straightforward process that allows users to apply for financing efficiently. This guide will lead you through each section of the application to ensure you provide accurate and complete information.

Follow the steps to complete your application with ease.

- Click ‘Get Form’ button to access the application and open it for filling out.

- Begin with the applicant's name by entering your first, last, and middle names in the designated fields.

- Provide your social security number in the assigned box for identification purposes.

- Fill in your mailing address, ensuring you include street address, city, state, and zip code.

- Enter your date of birth in the specified format.

- If your physical residence differs from your mailing address, provide the physical address details.

- Input your home telephone number and email address for communication.

- Indicate your marital status by selecting one of the options provided.

- Provide your work or cell number for further contact.

- List the name of the nearest relative not living with you, including their city, state, and phone number.

- State how long you have lived at your current address.

- Fill in legal business information if applicable, including business type and organization ID number.

- If your business is a partnership, LLC, or corporation, list information for all partners, owners, or officers.

- Detail your equipment use percentages across categories such as farm work or custom work.

- Include your primary lender's name and their contact information for reference.

- Input sources of other income and their amounts, including how often you receive these incomes.

- Complete financial sections, including annual gross income and other necessary financial details.

- If applicable, answer whether you farm full-time or part-time and provide relevant agricultural details.

- In the section about judgments or bankruptcies, answer honestly and attach necessary explanations if needed.

- Finally, ensure you sign and date the application, including a partner or co-signer if required.

- Review all provided information for accuracy before submitting. After completion, you may save, download, print, or share the form as needed.

Start filling out your Kioti Finance Credit Application online to take the next step in securing your financing.

Securing financing for a tractor with bad credit may seem challenging, but there are options available. Providing a larger down payment, demonstrating consistent income, or having a co-signer can improve your chances. The Kioti Finance Credit Application offers pathways to find financing solutions tailored for individuals with varying credit situations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.