Loading

Get Ira Form 2325 2002

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRA Form 2325 online

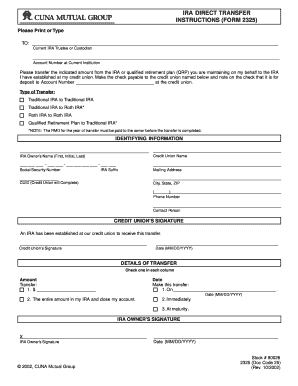

Filling out the IRA Form 2325 online is an essential step for transferring your IRA or qualified retirement plan funds. This guide will provide you with a straightforward and comprehensive approach to accurately complete the form, ensuring that your transfer process goes smoothly.

Follow the steps to effectively complete and submit the IRA Form 2325 online.

- Press the ‘Get Form’ button to access the form and open it in the online editor.

- In the first section labeled 'TO', enter the name of the current IRA trustee or custodian, followed by the account number at the current institution.

- Select the type of transfer you wish to perform by marking the appropriate box. Options include transferring from a Traditional IRA to a Traditional IRA, Traditional IRA to a Roth IRA, Roth IRA to Roth IRA, or a Qualified Retirement Plan to a Traditional IRA.

- Fill in your identifying information including the credit union name, your full name (first, initial, last), social security number, and IRA suffix.

- Complete the mailing address section with your street address, city, state, and ZIP code. Also, include your phone number and the name of a contact person at your credit union.

- Acquire the credit union's signature to confirm that an IRA has been established to receive the transfer, along with the date of the signature.

- In the 'DETAILS OF TRANSFER' section, indicate the amount you wish to transfer and the date of the transfer by checking the relevant options.

- Sign the form as the IRA owner and enter the date of your signature.

- Finally, save your progress, download the completed form, or print it for submission.

Complete your IRA Form 2325 online today for a seamless transfer process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To file your IRA on your taxes, begin by gathering documentation such as Form 1099-R and any contributions recorded on IRA Form 2325. Fill in the relevant sections on your tax return, ensuring accuracy and completeness. This thorough approach will help maintain your tax compliance and prevent future complications.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.