Get Insignia Macro Fund Ira Distribution Form 2015-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Insignia Macro Fund IRA Distribution Form online

Filling out the Insignia Macro Fund IRA Distribution Form online is a straightforward process that ensures your distribution request is handled efficiently. This guide provides clear, step-by-step instructions to help users complete the form accurately.

Follow the steps to complete your IRA distribution form online.

- Click the ‘Get Form’ button to access the Insignia Macro Fund IRA Distribution Form and open it in your preferred online editor.

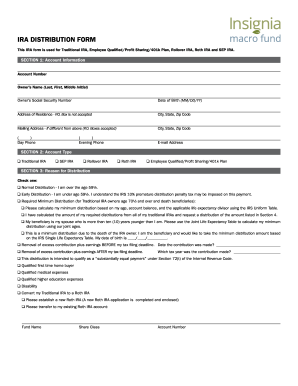

- Begin by filling out Section 1, which requires your account information. This includes entering your account number, owner's name (last, first, middle initial), social security number, date of birth, and current address. Ensure to provide a valid mailing address if it differs from your residential address.

- In Section 2, select your account type by checking the appropriate box next to one of the available options: Traditional IRA, SEP IRA, Rollover IRA, Roth IRA, or Employee Qualified/Profit Sharing/401k Plan.

- Proceed to Section 3 to provide the reason for your distribution. You must check one of the options listed, such as Normal Distribution, Early Distribution, or Required Minimum Distribution. Provide additional details if necessary, such as your spouse's age for joint life expectancy calculations.

- In Section 4, specify the distribution amount you wish to withdraw. You can choose to withdraw the total value from all funds or make a partial withdrawal by listing the fund names and amounts.

- Complete Section 5 by electing your tax withholding preferences. Choose whether you want federal income tax withheld from your distribution and indicate a percentage if applicable.

- In Section 6, indicate the payee details by selecting either the account owner, beneficiary, or a third party. If applicable, you will need to provide their social security number.

- Fill out Section 7 with your payment instructions, selecting how you would like to receive your funds, whether by check, ACH transfer, or wire transfer.

- If establishing a systematic withdrawal plan, complete Section 8 by providing details of how much you wish to withdraw regularly and the frequency of these withdrawals.

- Complete Section 9 by entering your bank information if required for ACH or wire transfers. Attach a voided check or savings deposit slip as instructed.

- In Section 10, sign and date the form certifying that you are the proper party to receive payment and that all information provided is accurate.

- If necessary, obtain a Medallion Signature Guarantee in Section 11, particularly if distributing amounts to an address or bank outside of the records.

- Lastly, review all sections for accuracy, save your changes, and proceed to download, print, or share the completed form as needed.

Complete your Insignia Macro Fund IRA Distribution Form online today for a smooth distribution process.

For COVID distributions, IRS Form 8915-E is the appropriate tax form to use. It allows for the reporting of authorized withdrawals made in response to the pandemic, which may have different tax treatments than standard distributions. By completing the Insignia Macro Fund IRA Distribution Form and Form 8915-E, you can enhance your ability to navigate the tax landscape surrounding these distributions.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.