Loading

Get H&r Block Form 307 2008

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the H&R Block Form 307 online

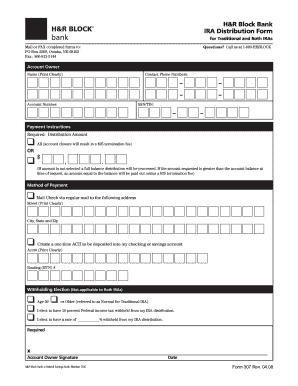

This guide provides a clear and comprehensive overview of the H&R Block Form 307, designed for individuals managing Traditional and Roth IRA distributions. Follow the instructions carefully to ensure your form is completed accurately and submitted successfully.

Follow the steps to fill out the form correctly

- Press the ‘Get Form’ button to access the H&R Block Form 307, which will open it in your online editor.

- Begin by filling in the account owner information. Clearly print your name, contact phone numbers, account number, and your Social Security Number or Tax Identification Number.

- In the payment instructions section, specify the distribution amount. You can choose to select 'All' to close the account (note the $25 termination fee), or enter a specific amount. If no amount is selected, a full balance distribution will occur.

- Select the method of payment for receiving your distribution. You can either request a check to be mailed to the provided address or initiate a one-time ACH transfer to your checking or savings account by entering the account number and routing number.

- If you are using a Traditional IRA and you are age 59 or older, indicate your withholding election. Choose whether you want 10 percent of your distribution withheld for Federal taxes or enter a different percentage.

- Ensure you provide your signature in the designated area to validate your request, and include the date of signature.

- Once all sections of the form are complete, you can save your changes, download the document for your records, print it for submission, or share it as necessary.

Complete your H&R Block Form 307 online today to efficiently manage your IRA distributions.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The injured spouse form allows a taxpayer to protect their share of a tax refund in case their spouse has outstanding debts. It’s crucial for joint filers who want to prevent the IRS from offsetting their refund due to their spouse's issues. H&R Block Form 307 can help streamline this process and guide you on how to file the injured spouse form correctly.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.