Loading

Get H&r Block Form 307 2014-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the H&R Block Form 307 online

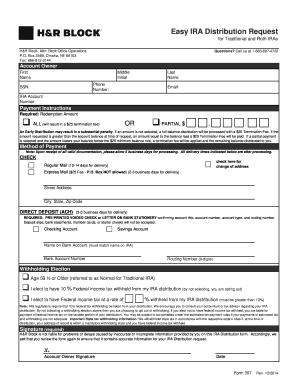

Filling out the H&R Block Form 307 online is a straightforward process that allows you to request distributions from your Traditional or Roth IRA. This guide will walk you through each section of the form, ensuring you complete it accurately and efficiently.

Follow the steps to complete your IRA distribution request

- Use the ‘Get Form’ button to access the H&R Block Form 307 and open it for editing.

- Begin by entering your personal details in the 'Account Owner' section. Provide your first name, middle initial (if applicable), last name, phone number, email address, and Social Security number.

- Next, input your IRA account number in the designated field to identify your account.

- In the 'Payment Instructions' section, select whether you want a full distribution (by checking the box for 'ALL') or a partial distribution. If opting for a partial distribution, specify the exact amount you wish to withdraw. Be mindful that opting for a full balance distribution incurs a $25 termination fee.

- Choose your preferred method of payment: check or direct deposit (ACH). If selecting check, indicate whether to send it via regular or express mail, remembering that express mail incurs a fee.

- If you select direct deposit, you must provide a pre-printed voided check or a letter from your bank confirming the account details, including the account title, number, type, and routing number.

- Complete the 'Withholding Election' section by indicating your age status and selecting any federal income tax withholding preferences. Ensure you understand the implications of opting out of withholding.

- Finally, review all provided information for accuracy. Sign and date the form in the designated space, as your signature is essential for processing your request.

Complete your H&R Block Form 307 online today to ensure a smooth IRA distribution process.

Related links form

To claim stock losses on your taxes with H&R Block, you will need to document each transaction carefully, showing your gains and losses. Use H&R Block Form 307 to report these losses, as it allows you to properly amend your tax documents. H&R Block provides guidance on how to fill out this form and ensures you don’t miss any deductions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.