Get Freddie Mac 65a/fannie Mae 1003a 2004

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Freddie Mac 65A/Fannie Mae 1003A online

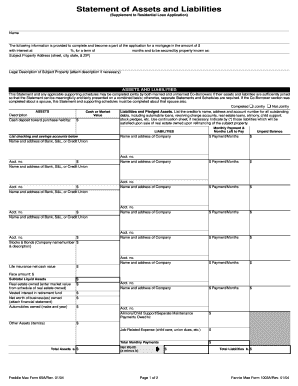

This guide provides step-by-step instructions for completing the Freddie Mac 65A/Fannie Mae 1003A online. It aims to assist users in accurately filling out the Statement of Assets and Liabilities as part of their mortgage application process.

Follow the steps to fill out the form successfully.

- Click ‘Get Form’ button to access the Freddie Mac 65A/Fannie Mae 1003A and open it in the designated online editor.

- Begin by providing your name and the mortgage amount you are applying for, along with the interest rate and term in months.

- Input the subject property address, including the street, city, state, and ZIP code.

- If necessary, attach the legal description of the subject property.

- Indicate whether the Statement of Assets and Liabilities is completed jointly or not; this applies to co-borrowers.

- List all outstanding debts under the Liabilities section, including the creditor’s name, address, account number, unpaid balance, and monthly payment structure for each debt.

- In the Assets section, list all cash or market values for checking and savings accounts, stocks, bonds, and any other assets.

- Provide details for additional asset categories, such as real estate owned, automobiles, and any alimony or child support payments owed.

- Complete the Schedule of Real Estate Owned if applicable, listing each property address along with its market value, mortgages, and rental income.

- Review your entries for accuracy and completeness, ensuring all information is correct.

- Once all sections are filled out correctly, you can save your changes, download, print, or share the completed form.

Start completing your Freddie Mac 65A/Fannie Mae 1003A online today to streamline your mortgage application process.

Get form

The Freddie Mac Form 65 is a standard mortgage application used by lenders to gather critical borrower information. It captures essential details including income, assets, and property information to determine eligibility for Freddie Mac-backed loans. Understanding this form is crucial for securing your mortgage efficiently. For more guidance, resources are available on USLegalForms to help you navigate the application process smoothly.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.