Loading

Get Form 8283 (rev. October 1998) - Internal Revenue Service

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8283 (Rev. October 1998) - Internal Revenue Service online

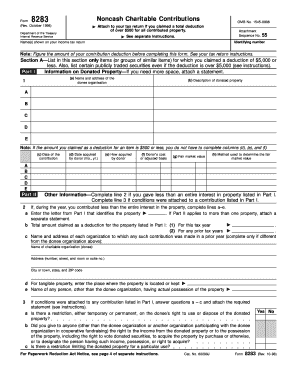

Filling out Form 8283 is essential for individuals claiming noncash charitable contributions exceeding $500. This guide aims to provide clear, step-by-step instructions on accurately completing this form online, ensuring users can easily meet their tax obligations.

Follow the steps to effectively complete the form.

- Press the ‘Get Form’ button to download the form and open it in your preferred editing platform.

- Begin by filling in the name(s) shown on your income tax return and your identifying number at the top of the form.

- In Section A, list items for which you are claiming a deduction of $5,000 or less, starting with the name and address of the donee organization, followed by the description of the donated property.

- For each item in Section A, record the date of contribution, the date acquired by you as the donor, how you acquired the item, the donor’s cost or adjusted basis, and the fair market value.

- Complete Part II of Section A if you contributed less than the entire interest in the property, detailing the properties and any conditions attached to the contributions.

- In Section B, report items valued at more than $5,000. Select the type of property and provide a description. Include information on the appraisal and its fair market value.

- Sign and date the Taxpayer Statement and ensure that all entries are accurate before submission.

- Once all sections are completed, save changes, download the completed form, or print it for your records. Be sure to attach it to your tax return.

Start filling out your Form 8283 online today to ensure compliance and maximize your tax benefits.

Related links form

You can make a tax-free gift with a Qualified Charitable Distribution (QCD) from your IRA. (Other Qualified Retirement Plans such as 401(k)s and 403(b)s are not eligible). You must be at least 70½ years old to take advantage of this opportunity.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.