Loading

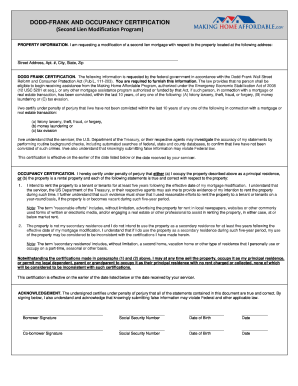

Get Dodd-frank And Occupancy Certification

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Dodd-Frank and Occupancy Certification online

Filling out the Dodd-Frank and Occupancy Certification is an important step for those seeking modification of a second lien mortgage. This guide will provide clear and supportive instructions on how to complete this form online, ensuring compliance with relevant regulations.

Follow the steps to accurately complete the Dodd-Frank and Occupancy Certification

- Click the ‘Get Form’ button to obtain the form and open it in a suitable editor.

- Begin by filling in the property information section. Enter the full street address, including the apartment number, city, state, and zip code.

- Complete the Dodd-Frank Certification section by providing the required details. Acknowledge that you have not been convicted within the last 10 years of any serious offenses related to mortgage or real estate transactions. Ensure to check the appropriate boxes regarding your criminal history.

- In the Occupancy Certification section, state if you occupy the property as your principal residence or if it is a rental property. If it is a rental, confirm your intention to rent it for at least five years and detail your efforts to secure tenants.

- Review the notes regarding what constitutes 'reasonable efforts' to rent the property, including potential advertising methods that meet this criterion.

- Provide additional affirmations related to the property’s usage, confirming it will not be used as a secondary residence for the specified duration.

- Complete the acknowledgment section by signing and providing necessary personal information, including social security numbers and birth dates for all borrowers.

- Once all sections are filled out accurately, save changes, and you can choose to download, print, or share the completed form.

Complete your Dodd-Frank and Occupancy Certification online now to ensure a smooth modification process.

The Dodd-Frank Act primarily seeks to protect consumers and promote economic stability by regulating financial institutions. It serves to prevent harmful practices that contributed to the 2008 financial crisis. By focusing on transparency and accountability, Dodd-Frank and occupancy certification work together to uphold a fair financial marketplace.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.